March was a decent month for traditional asset classes, capping off a solid first quarter to start the year. However, the journey during the month was certainly far from what anyone would have anticipated as the month began. Stubborn inflation continued to be a concern as investors try to anticipate the tightening trajectory of the Federal Reserve. Economic data remains largely mixed and, for this reason, rather inconclusive. What was certainly not anticipated as the month began was a mini bank crisis, triggered by the failure of Silicon Valley Bank (“SVB”). Following a tenuous few weeks, the crisis – at least for now – seems to be contained. Investors ended the month more focused on the positive effects of lower interest rates ahead rather than on the negative effects of tightening conditions in the credit markets, even though there are progressively more warning signals that the U.S. economy may slow in the months ahead.

March Themes

SVB failure: The failure of SVB, and Signature Bank, in early March was followed two weeks later by the “shotgun” wedding between two Swiss powerhouses, and global systemically important banks, UBS and long-troubled Credit Suisse. These events led to an understandable degree of nervousness in global financial markets.

- In the case of SVB, the bank was unfortunately weakened by poor investment decisions involving their liquid investment book (related to mismatched duration risk).

- When depositors and investors suddenly decided to focus on this issue, customer confidence evaporated almost overnight leading to an old-fashioned run-on-the-bank. Outflows of deposits occurred so quickly that the bank ran out of cash and had to be taken over by the FDIC.

- A few days later, SVB depositors were handed a gift by the FDIC, which decided to guarantee all deposits of the failed bank, including deposits in excess of the FDIC insurance threshold amount of $250,000.

- Investors were on edge for several days following the failure of SVB as there were concerns that similar scenarios could play out involving other mid-sized U.S. banks.

- Ultimately, as we reached the end of the month, investors realized that this risk was isolated and idiosyncratic, causing pressure on banks to lessen. As this mini-crisis seemed to be resolved for now, investors shifted their focus from banks and back onto the economy.

Knock-on effects of the mini bank crisis on credit markets: Even if bank concerns are contained for now, the mini bank crisis will likely have knock-on effects on future U.S. economic growth. Specifically, concerns about liquidity and potential deposit outflows will almost certainly cause banks to tighten their lending standards.

- As credit conditions tighten, the economy may likely slow. To a certain extent, this could help the Federal Reserve with its efforts to slow inflation. Investors in fact have recalibrated their tightening trajectory, expecting fewer increases in the Federal Funds rate, a lower terminal rate, and perhaps even a Fed pivot this year.

- U.S. Treasury yields fell sharply during the crisis, and lower yields and lower expectations regarding future direction of interest rates boosted interest rate sensitive stocks, especially stocks of technology companies.

Monetary policy: The Federal Open Market Committee (“FOMC”) of the Federal Reserve announced on March 22 that it would increase the Federal Funds rate 25bps as expected, to a target range of 4.75% to 5.00%1. What had become a discussion about whether the increase would be 25bps or 50bps was tempered by the failure of SVB, which sharply ratchetted back investors’ expectations as far as future rate increases.

- The 25bps increase may be fair at the end of the day as inflation remains problematic.

- The lag in the economic effect of higher interest rates and tighter lending conditions (likely spawned by the bank crisis) will work through the economy in the coming weeks, likely slowing the trajectory of growth.

- The next FOMC meeting is not until May 2-3, but there will be a slew of additional economic data by then to consider.

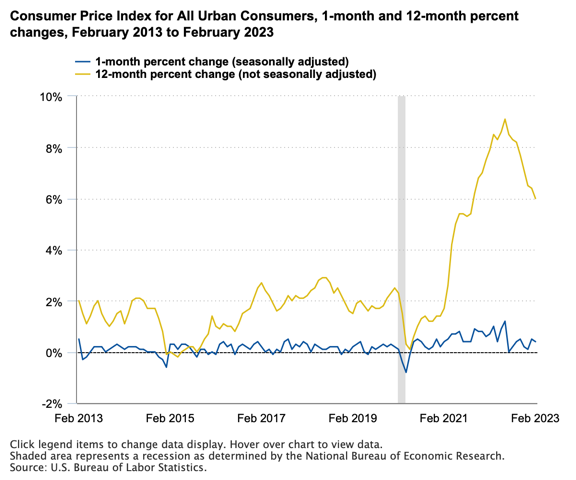

The economy: Inflation remains elevated albeit it is slowly declining.

- The situation is similar in the Eurozone, with inflation declining but much less slowly than hoped.

- U.S. CPI data2 for February was released on March 14, indicating that February month-over-month CPI was 0.5% (vs. 0.4% for the prior month-over-month), and year-over-year core CPI was 5.5%. As can be seen in the graph below, CPI is declining.

- The Fed’s preferred inflation gauge – change in personal consumption expenditure (PCE) – was released on the last day of March. It also declined in February3, albeit certainly more slowly than the Fed would have liked.

- In spite of the Federal Reserve’s aggressive tightening steps which started in March 2022, the U.S. employment market has remained buoyant. The U.S. unemployment rate ticked up slightly in February to 3.6% per annum4 but remains around record low levels as there is little indication yet that the economy is slowing.

Asset Class Performance

Global Equities: The benchmark global equity indices were all positive in March, recovering from uncertainty mid-month, attributable to the failure of SVB and the overall mini bank crisis, to claw back losses and register solid gains in March.

- The S&P 500 was up 3.5%, bringing its year-to-date gain to 7.0%.

- However, European and Japanese equities have outperformed the benchmark U.S. index in the first quarter, although both had lower returns in March.

- The emerging markets index and Chinese equities are also both green YtD, although it has been a more volatile ride. The direction of travel of the U.S. Dollar is important for emerging markets equities, with a slowly weakening U.S. Dollar benefiting these markets. China seems to drift in and out of favor, largely dependent on geopolitical news.

U.S. Equities: U.S. equities ended on a positive note in March, with the S&P 500 delivering its best weekly gain (+3.5%) of the year.

- This year has seen a rotation out of large cap and value stocks back into technology and higher-volatility stocks.

- Following a disastrous 2022 in which the NASDAQ Composite was down over 33%, the tech-heavy index has moved sharply higher the first three months of 2023, racking up a gain of 16.9% in the first quarter, more than double the return of the S&P 500 over the same period.

- The strong performance of the NASDAQ reflects a recovery from over-sold 2022 levels as well as improved expectations towards more dovish monetary policy from the Federal Reserve in the near future.

- Having risen above 30 at one point during the mid-March mini bank crisis, the VIX index (measure of market volatility) closed back below 19 as the month ended, levels not pierced since the autumn of 2022. This may be a signal, perhaps erroneous, that investors do not see significant risks on the horizon.

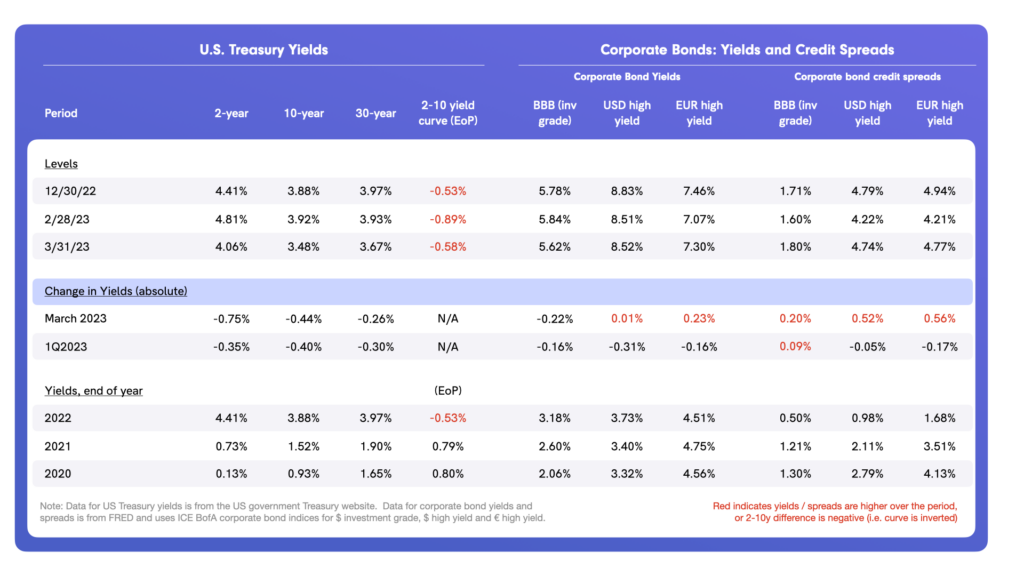

Bond Yields / Credit Spreads: With a bid for safe haven assets emerging during the mini bank crisis, coupled with the revision of interest rate expectations resulting from said crisis, U.S. Treasury bonds rallied in March, registering solid gains.

- The yield on the 2y UST decreased 74bps in March, and the yield on the 10y UST decreased 44bps.

- The difference in the 2y-10y yields also narrowed sharply during the month, with the difference (i.e. an inversion) going from -89bps at the end of February to -58bps at the end of March.

- Yields at the shorter end of the curve reflect expectations that the Fed will reach a maximum Fed Funds rate, which is now lower than expected only a few weeks ago and will likely “pivot” sooner towards looser monetary policy.

- Yields at the long end of the curve suggest that the U.S. economy may likely slow more severely than expected a month ago.

- Corporate credit spreads widened sharply in March, with weaker-rated credits being the most-adversely affected. This reflects the expectation that credit markets may likely tighten going forward, especially as mid-sized and small U.S. banks alter their lending policies to reflect a more conservative approach following the failure of SVB.

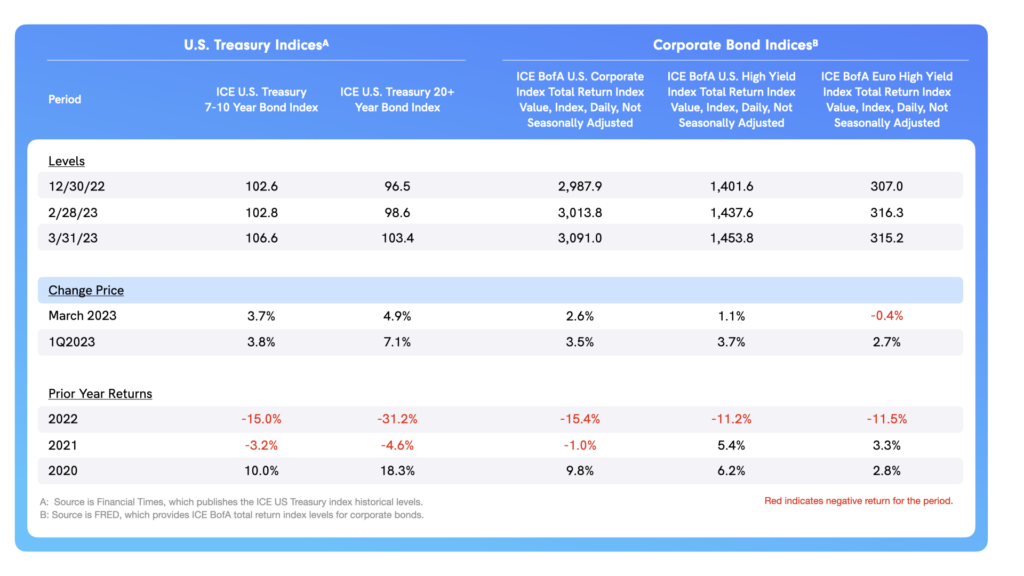

Total Returns: U.S. Treasuries and investment grade corporate bonds registered solid gains in March as yields declined. Even though yields were lower, high-yield bonds were more or less flat during the month as credit concerns linger.

- The total return on the 20+ UST index was the same as the return on the S&P 500 in the first quarter, showing again that these asset classes can be positively correlated.

Currencies, Commodities and Alternative Assets: The U.S. Dollar weakened in March after re-strengthening in February, resulting in the greenback being down 1.0% for the year.

- The price of WTI crude oil was down 1.8% in February and is now down 5.7% on the year. Lower oil prices continue to reflect potential demand destruction as the global economy slows.

- Bitcoin has gained a sizzling 71.5% year-to-date, with solid 23% gain in March adding to its increase for the year. The benchmark cryptocurrency remains resilient in spite of increasing noise in the cryptocurrency infrastructure, speaking to its transition into a credible asset class.

- Commercial real estate remains a concern for markets, especially since banks and insurance companies have a chunky allocation to this asset class. Although the year-to-date return for the US REIT index trails the S&P 500, it is nevertheless positive for the year as investors do not seem to be abandoning the asset class completely.

April Outlook

March was great across most asset classes that it is difficult to see April offering a repeat of this performance. Investors may not be in tune with growing signals that suggest a slowing U.S. economy.

Although inflation will continue to slow, the Federal Reserve remains singularly committed to its focus until it has visibility of its 2% per annum inflation target. This ongoing approach, coupled with slower growth in credit, will almost certainly do more damage to the economy than is currently expected.

The next FOMC meeting is not until early May, and between now and then, we will see further economic data points that are important. Additionally, earnings for the first quarter will begin being reported in mid-April, which will be influential as to the direction of equity prices.

2U.S. Bureau of Labor Statistics CPI, February release

3US Bureau of Economic Analysis “Personal Income and Outlays, February 2023”

4US Bureau of Labor Statistics employment report for February

Register for Percent’s Quarterly Investor Update

Join us on April 13 for the second Quarterly Investor Update of 2023, featuring Percent Founder and CEO, Nelson Chu, and President, Prath Reddy, CFA, in a presentation moderated by Chief Marketing Officer, Jessica Zall.

About the Author

Tim Hall is a writer, speaker, blogger (emorningcoffee.com), consultant, and advisor. A former banker with 29 years of experience (buy side/sell side), Hall is also a former Independent Non-Executive Director of a U.K. “challenger bank.” He currently resides in London.