Glossary

Definitions to terminology used on the Percent platform.

Accredited Investor

Learn more about accredited investors here.

There are several ways of establishing accredited investor status:

- You have earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expect the same for the current year

- You have a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

- You are an investor with certain professional certifications, designations, and/or credentials, including Series 7, Series 65, and Series 82 licenses while qualifying as “natural persons.” (Investors with other licenses are to be considered and added in the future.)

- You are an investor with a “spousal equivalent,” or a spouse of an accredited investor who pools their assets along together to meet the previous net worth and/or income requirements for accredited investors. (Eg. If you are married to an accredited investor and share monetary resources, you are now also an accredited investor.)

- You are “knowledgeable employees” of a private fund.

- Limited Liability Companies (LLCs) and Family Office entities with $5 Million assets under management. SEC- and state-registered investment advisers (but not reporting advisors) of these entities can also now be considered accredited investors.

- Entities including Native American tribes, governmental bodies, funds, and entities “organized under the laws of foreign countries” with investments over $5 million — as long as they were not formed solely to invest in a specific accredited investment.

Alternative Investments

An alternative investment is an asset that is not a conventional investment type, such as stocks, bonds and cash.

Learn more about alternative investments here.

AML

Anti-Money Laundering (AML) specifically refers to all policies and regulation that force financial institutions to proactively monitor their clients in order to prevent money laundering and corruption. These laws also require both that financial institutions report any financial crimes they find and that they do what is possible to stop them. At Percent, the KYC process is one of the key components to the company AML program.

Learn more about anti-money laundering here.

Amortization

Amortization is the gradual repayment of a debt over a period of time. These payments often are an aggregate of the interest accrued as well as the principal owed.

Learn more about amortization here.

Annualized Default Rate

At times, it may be worthwhile to look at defaults on a portfolio of assets over a particular period, instead of on a “per vintage” basis. This might be particularly helpful for comparing assets of varying durations. The idea follows the logic that a 5% default rate on a 12-month loan presents a different amount of credit risk than a 5% default rate on a 3-month loan reinvested 4 times over the same year. Essentially, an Annualized Default Rate measures cumulative defaults per dollar invested in the underlying assets and reinvested over one year. At Percent, we calculate it as follows: ![]()

APY

Annual Percentage Yield (APY) is the yield on aninvestment in one year, taking into account the effects of compounding.

Learn more about Annual Percentage Yields here.

Asset Class

An asset class is a group of securities that exhibits similar characteristics, behaves similarly in the marketplace, and is subject to the same laws and regulations. In the public markets, there are three main asset classes: equities (stocks), bonds, and money market instruments. In alternative investing, asset classes can include real estate, commodities, cryptocurrencies, etc.

Borrower

This refers to the firms raising capital from investors on Percent’s platform. It may include specialty finance companies, venture capital-backed startups, mid-sized non-financial businesses, and others. In some cases, a borrower may raise debt or debt-like capital through an intermediary (such as a special purpose vehicle or subsidiary) and under a variety of structures or contract types.

Buy Now, Pay Later (BNPL)

A form of consumer lending where a borrower spreads out the purchase of a product over a series of payments. Originators of BNPL installment loans are often tech-enabled but may serve both e-commerce and brick-and-mortar businesses and their customers.

Callable Note

A callable note is a note in which the issuer reserves the right to return the investor’s principal and stop interest payments before the note’s maturity date.

Learn more about callable notes here.

Collateral

Collateral is an asset pledged to a financing provider as a guarantee for repayment of a loan. It is to be forfeited to the financing provider in the event of a default.

Learn more about collateral here.

Compounded Interest

Compound interest is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

Learn more about compound interest here.

Counterparty Risk

Counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations. It is the likelihood or probability that one of those involved in a transaction might default on its contractual obligation.

Learn more about counterparty risk here.

Day Count Convention

A Day Count Convention is the approach used to accrue interest over time. We market our deals using an APY but in calculating monthly interest payments, we presume a fixed 30 day month and a 360 day year. This is a common industry practice and allows interest payments on the 1st of each month, for example, to be of equal size regardless if the month had 30 days or 31 days.

Debt Securities

A debt security is a financial instrument issued by an entity and sold to an investor. The security has a loan as its underlying asset and it represents an obligation for the investor to be paid back the face value plus interest income as the instrument matures. The most common type of debt security are bonds such as corporate bonds or government bonds.

Learn more about debt securities here.

Default

A failure to make scheduled loan payments when they come due is considered a default. The consequences of a loan default depend on whether the debt is secured or unsecured. A secured loan is debt that’s related to a specific asset. If you default on a secured loan, the financing provider might respond by claiming the underlying asset.

Learn more about defaults here.

Deposit Account Control Agreement (DACA)

A deposit account control agreement (DACA) may be used by a lender to more easily take control of a bank account, typically in an event of default by a borrower. If implemented in advance, a deposit account control agreement can be triggered so that the bank may no longer honor the payment instructions of the borrower and may only honor those of the lender.

Disbursement

A disbursement is a payment from an investment. For example, in an amortizing investment, disbursements of principal and interest are made periodically in accordance with the amortization schedule. In non-amortizing deals, disbursement is made in a lump sum upon deal maturity.

Distributed Ledger Technology

Distributed ledger technology is a consensus of share, and synchronized data dispersed across multiple nodes or sites. There is no central administrator of data, but rather a peer-to-peer network, where each replicates and saves an identical copy of the ledger and updates itself independently. The lack of authority allows for a source of truth that is immutable.

Due Diligence

Due diligence is an investigation or audit of a potential investment opportunity or product to confirm facts and/or uncover risks. Due diligence refers to the research done before entering into an agreement or a financial transaction with another party. For example, when purchasing a business the investor may want to review financial records or visit the business in person. Percent has a stringent due diligence process as a part of the company.

Learn more about due diligence here.

Earned Wage Access

Earned wage access is a service providing employees access to accrued wages in advance of payday. This is not typically regarded as a loan but rather a payroll solution provided in partnership with payroll processing firms.

Etherscan

Etherscan is the leading BlockExplorer for the Ethereum Blockchain. A BlockExplorer is essentially a search engine that allows users to easily lookup, confirm and validate transactions that have taken place on the Ethereum Blockchain.

Factor Rate

The ratio of a receivable’s initial outstanding amount (or ‘payback’ amount) to the amount that was paid for that receivable. Factor rates are often used in measuring the return of a merchant cash advance.

FIGI

The Financial Instrument Global Identifier (FIGI) is an open standard, unique identifier of financial instruments that can be assigned to instruments including common stock, options, derivatives, futures, corporate and government bonds, municipals, currencies, and mortgage products.

First Loss Cushion

In the context of a Percent note, the first loss cushion is a form of credit enhancement that requires borrowers to absorb a percentage of any losses from the asset pool to a predetermined point provision.

Holding Period Rate (HPR)

Holding period rate (HPR) is the change in value of an investment, asset or portfolio over a particular period. It is the entire gain or loss, including principal and interest, divided by the value at the beginning of the period. On Percent, for notes divided into different periods between which interest or principal repayments are made, the total HPR for the investment horizon is the sum of the holding period rates for each period.

For example, consider the HPR on a 2 month $100 note that pays 1% per month and amortizes half the note amount after month 1. The HPR would be as follows:![]()

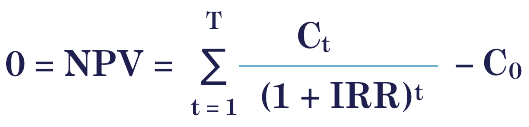

Internal Rate of Return (IRR)

IRR is the rate of return that equates the present value of an investment’s expected gains with the present value of its costs. It’s the discount rate for which the net present value of an investment is zero. In other words, it is the ROI discounted for future cash flows.

NPV= net present value

T= number of time periods

Ct= total net cash flow during period t

C0= total initial investment costs

r= discount rate

*This formula is best solved by using a financial calculator or Excel

Read about whether this returns calculation is the optimal one for your portfolio in Percent’s blog article.

Invoice Factoring

Invoice Factoring is a financial transaction and a type of debtor finance. In an invoice factoring, a business sells its accounts receivable (e.g. invoice) to a third party (called a factor) at a discount. A company will sometimes factor its receivable assets to meet its present and immediate cash needs. It might also factor their invoices to mitigate credit risk.

KYC

Know Your Customer (KYC) is a regulatory customer identity verification process to assess and monitor customer risk and a legal requirement to prevent banks or other firms from being used for money laundering activities. KYC is one of the several identity verification processes used by Percent.

Lien

A right to keep possession of property or assets belonging to another counterparty until a debt owed by that person is discharged

Litigation Finance

Litigation finance is a form of financing for plaintiffs in a lawsuit where a funder advances against the settlement value of a legal case. The funder receives a portion of the final judgement or settlement, but this return is contingent on the plaintiff winning the case.

LTV

The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset lent against.

Merchant Cash Advance (MCA)

Merchant cash advance (MCA) is a form of financing that allows a company to sell a portion of its future sales in exchange for an immediate payment. This financing provides the company with funds to pay operational expenses and to grow.

Mortgage Loan

A mortgage loan is a loan secured by real estate. In the event of default, the lender can typically compel the sale of the property or take control of it.

Origination

The moment and process of entering into a financial contract. For a lender, accepting an application and extending a cash advance or a loan results in the “origination” of a new financial asset.

Participation Agreement (PA)

A participation agreement is the legal contract transferring economic ownership of underlying assets from one party to another while maintaining the seller as servicer of underlying assets.

Participation Interest

Participation interest refers to the percentage of total assets purchased by Percent from the borrower’s existing portfolio.

PIK (Payment-in-kind)

PIK (Payment-in-kind) is a form of payment where accrued interest is satisfied through a corresponding increase to the outstanding Unsecured Note balance.

Private Placement Memorandum (PPM)

A Private Placement Memorandum (PPM) is a document providing information about a proposed private placement of securities, where a company sells securities to select investors, rather than releasing them to the public.

Purchase Order Financing

Purchase order financing is a funding solution for businesses that lack the cash flow to complete customer orders. It is an advance from a financing company that pays your supplier to manufacture and deliver the goods to the customer. The financing company will use the purchase order as an indication of future income and as collateral.

Regulation D

In the United States, under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt them from such registration.

Regulation D (Reg D) is a SEC regulation governing private placement exemptions. Reg D offerings are advantageous to private companies or entrepreneurs that meet the requirements because funding can be faster to obtain and less costly than with a public offering.

Return on Investment (ROI)

ROI is the percent difference between the current value of an investment and the original value.

Read about whether this returns calculation is the optimal one for your portfolio in Percent’s blog article.

Revolving Loan

A loan arrangement that allows for the loan amount to be withdrawn, repaid, and redrawn again any number of times, until the arrangement matures.

Rollover Loan

A rollover loan is essentially a loan that gets refinanced at a defined point. This refinancing may or may not be stipulated in a loan contract. The terms and conditions of the new loan may be different from those of the original loan.

Learn more about rollover loans here.

SEC Reg D Exempt Rule 506(b)

Companies that comply with the requirements of Rule 506(b) do not have to register their offering of securities with the SEC. The issuer does not need to verify the accredited investor status of participants, but no general solicitation or advertising can be done to market the offering.

SEC Reg D Exempt Rule 506(c)

Companies that comply with the requirements of Rule 506(c) do not have to register their offering of securities with the SEC. Under 506(c), the issuer must take steps to verify the accredited investor status of participants.

Securitization

Securitization, the practice of pooling together various types of debt instruments (assets) such as MCAs and other consumer loans and selling them as bonds to investors.

Security Token

Security tokens typically represent a financial interest in the issuer of the security. Security tokens regulated as they are the digital representation of traditional financial instruments.

Smart Contract

Smart contracts are self-executing contracts with the terms of the agreement between counterparties being directly written into lines of code. Smart contracts permit trusted transactions and agreements to be carried out among counterparties without the need for intermediaries. They render transactions traceable, transparent, and irreversible.

SMB

A small and mid-sized business (SMB).

Special Purpose Vehicle (SPV)

A special purpose vehicle is a “bankruptcy-remote entity” that a parent company uses to securitize assets. SPV operations are limited to the acquisition and financing of specific assets as a method of isolating risk. It is a subsidiary company with an asset/liability structure and legal status that makes its obligations secure, even in the event that parent company goes bankrupt or ceases operations.

Subordinated Debt

Subordinated debt is a debt that ranks below other, more senior loans or securities with respect to claims on assets or earnings. A ‘second-lien’ loan is an example of a loan that is secured but subordinated to another claim.

Term Loan

A term loan is a monetary loan that is repaid in regular payments over a set period of time.

Tokenization

Tokenization is the process of converting a physical asset into a token that can be transferred, recorded, and stored on a blockchain.

Vintage

Vintage is the time period when a financial asset was originated. Also, assets originated during the same calendar period are said to collectively comprise a “vintage.” For example, if a lender made a loan on January 12th, 2020, that loan’s vintage would be “January 2020.” Further, all loans originated that month could be called the “January 2020 vintage.” One way of measuring underwriting quality is to track past vintages over time.

Wallet Address

When you invest in a deal, a digital security is issued to represent your investment on-chain. Percent does not use cryptocurrencies and does not have its own token. All transactions are immutable and traceable but at the same time anonymized. Each address represents an investor and tracks their investment activity.

Whole Business Securitization

A whole business securitization (WBS) is a transaction in which an issuance of notes is secured by a pool of income-generating assets (other than “financial assets” like loans or receivables) that make up substantially all the revenues of a business.

Working Capital

Working capital is the money a business uses in its day-to-day trading operations. It is calculated as the current assets minus the current liabilities.