Reach investors and source the capital you need

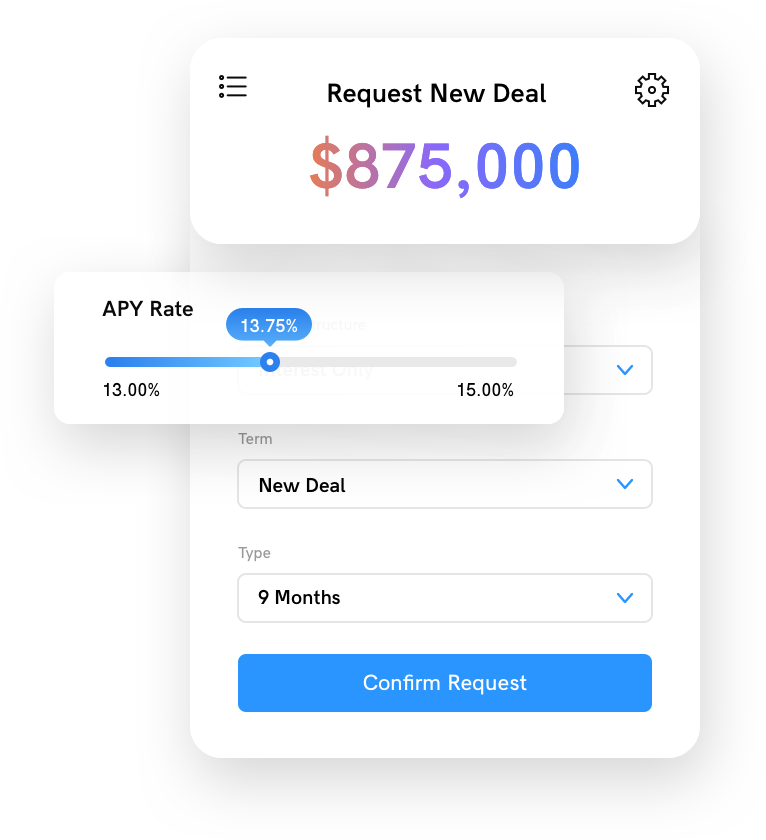

Our rates always reflect the current interest rate environment while our terms reflect our understanding of the needs of your growing business. Reach thousands of accredited and institutional investors, the best web-based platform powering the future of private debt markets.

Percent simplifies your path to directly and efficiently accessing accredited investors to secure debt capital at market-clearing rates. Our dynamic pricing is based on a 100% transparent auction system where you control your cost of capital.

Since 2018, Percent borrowers have raised over $1B across 600+ structured products.