How Does Venture Investing Work?

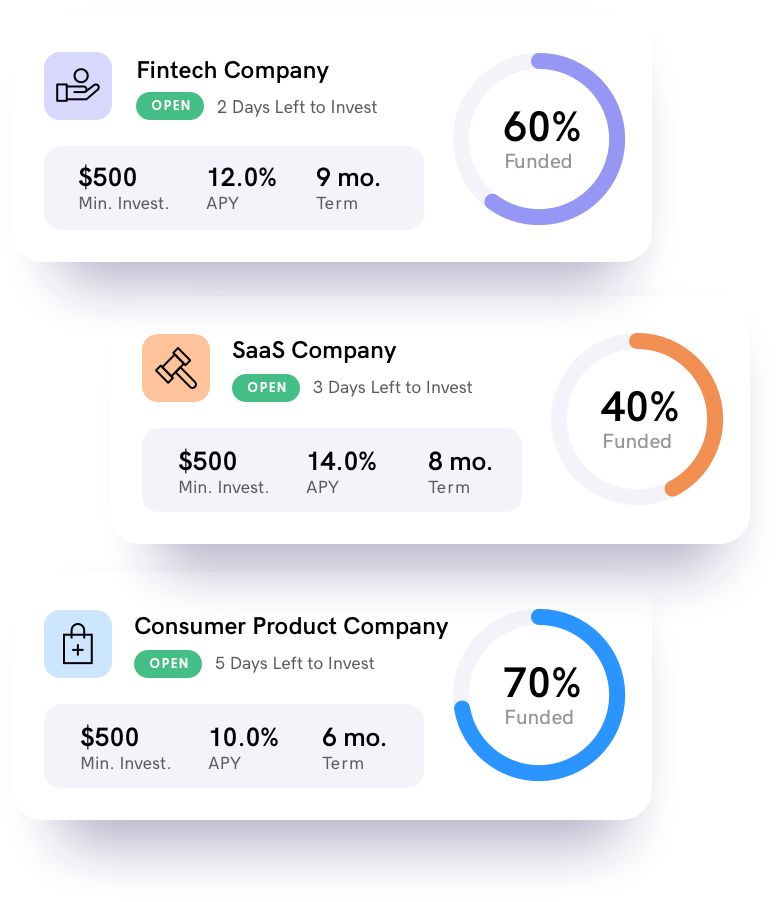

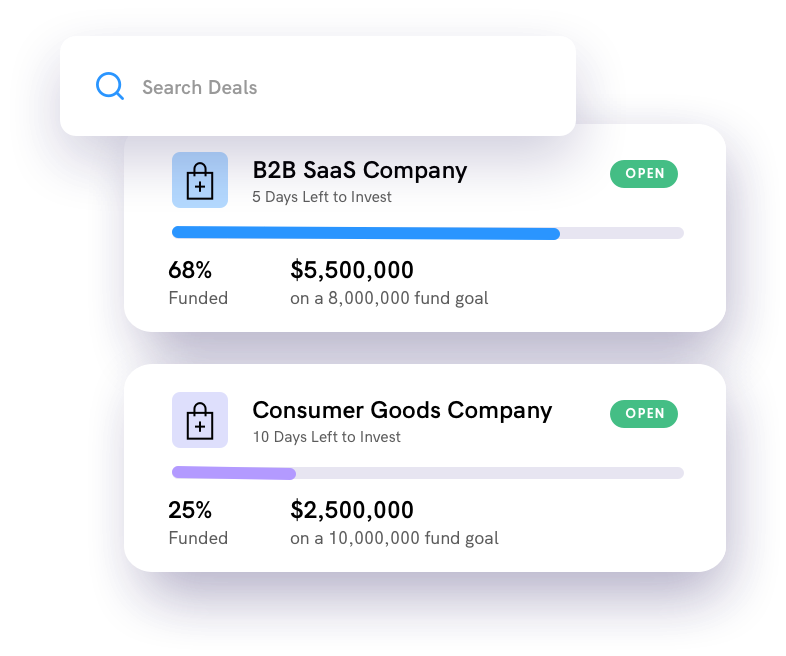

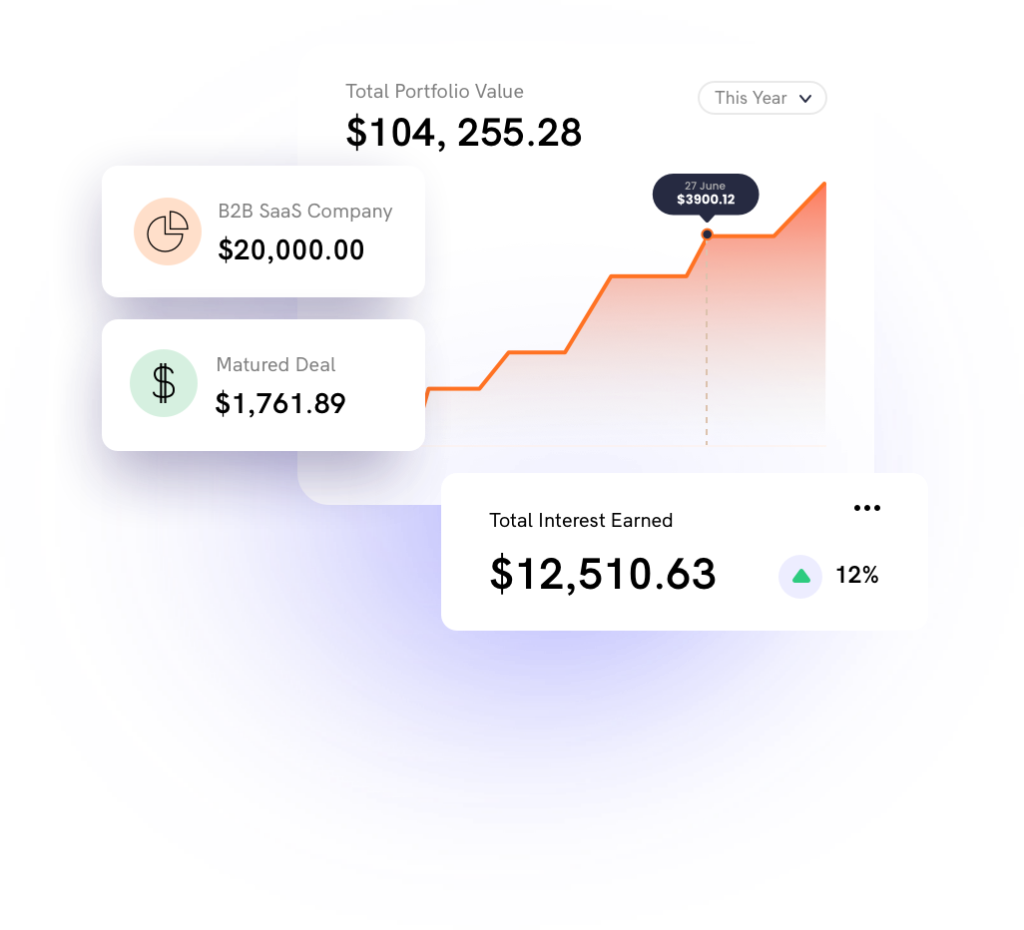

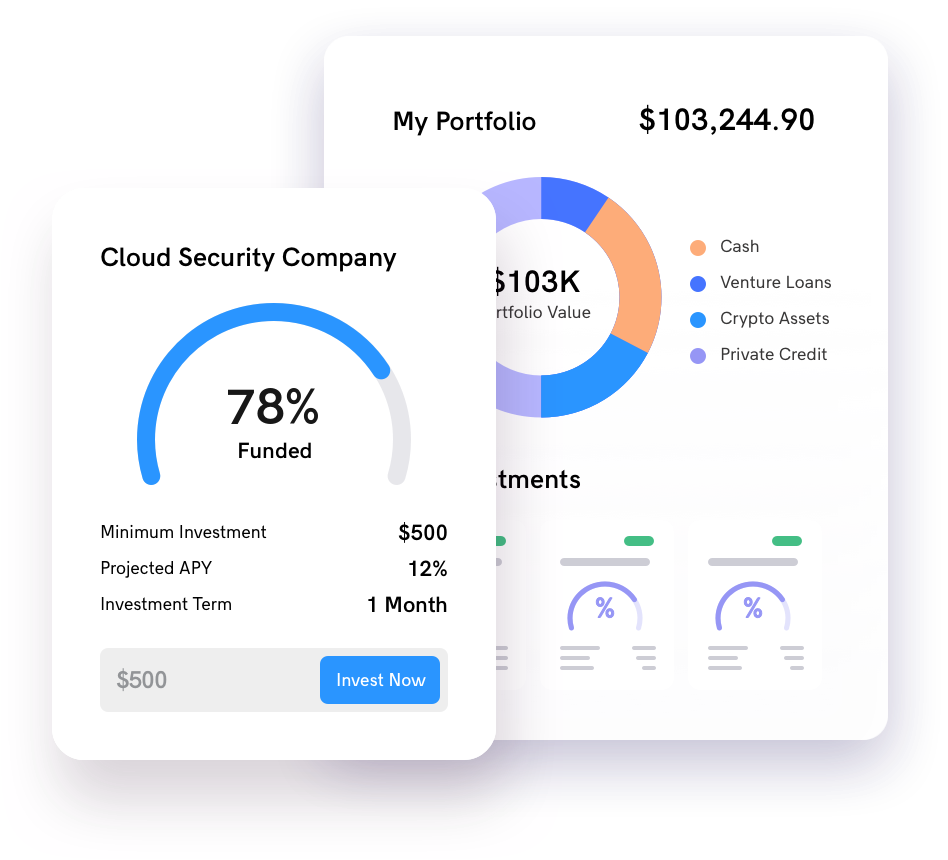

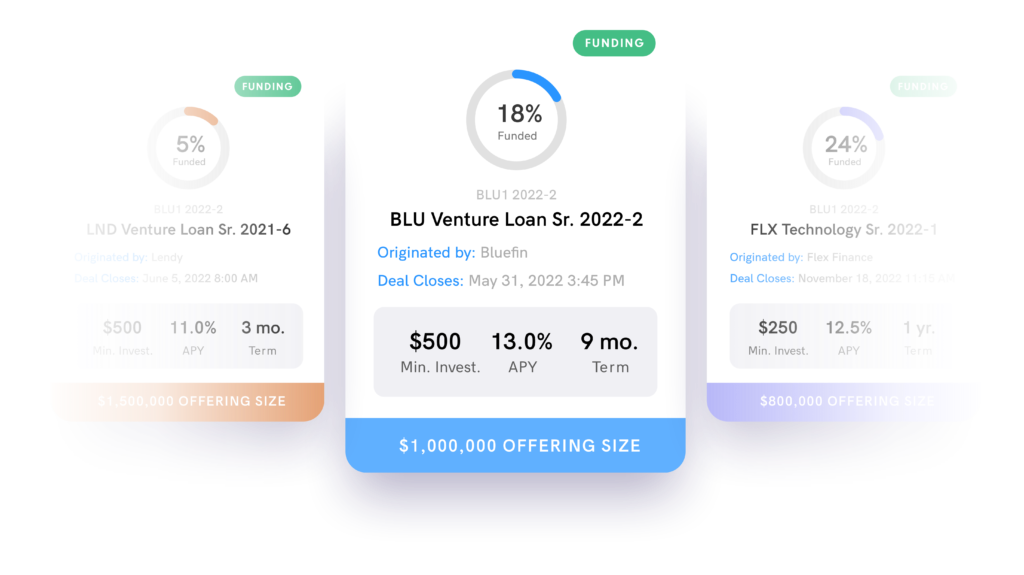

Venture debt investing provides high-growth companies with capital to grow their business. For investors, venture debt typically involves short-term debt investments that can provide higher yields and short-term exposure to these companies as they seek financing between fundraising rounds. The loans are designed to be repaid upon their next round of equity financing.

Learn More