This article is the second part of a series on the history of private credit investing. For access to the first article in the series, click here.

As the private debt market broadened and deepened throughout the 1990s and early 2000s, alternatives to senior leveraged bank debt or high yield loans began evolving — mainly through the growth of securitized debt vehicles like Collateralized Loan Obligations (or “CLOs”). CLOs were a precursor to private debt funds, as they provided institutional investors with the opportunity to de facto invest in bank loans for the first time and to tailor risk to their appetite. The leveraged loan market had been principally the purview of commercial banks until CLOs began to proliferate. These new instruments expanded the debt markets and served as a precursor to further evolution, which would follow the GFC.

CLOss were essentially securitizations of pools of bank-underwritten leveraged loans (and, occasionally, high-yield bonds). The collateral consisted of a diversified pool of non-investment-grade rated (or implied non-investment-grade rated) loans. The CLO would then issue debt in tranches determined by seniority in the CLO collateral, with ratings ranging from Aaa/AAA (first claim on cash flows from the loans, lowest risk/return) to BB (next to last claim on cash flows from the loans, highest risk/return), with a sliver of equity (typically10%) at the bottom of the capital structure.

CLOs allowed institutional investors to participate indirectly in the leveraged loan market, and tailor investments to a specific risk-return profile by targeting specific tranches. This growth of CLOs became a major factor in the growth of the non-investment-grade bank debt market, expanding the market and allowing commercial banks to more comfortably underwrite larger and larger amounts of non-investment grade loans which they could then “de-risk” during the syndication process. Leading commercial banks involved in leveraged lending for buyouts became increasingly bold in underwriting larger and larger amounts of risky senior debt. The same was true in the mortgage market, where subprime mortgages were proliferating, pushing U.S. real estate prices higher and higher during the 2005-2007 period. In fact, it was arguably the proliferation of certain mortgage-backed securities that triggered the Great Financial Crisis in late 2007.

Even with the extensive growth and broadening of the private debt markets up until the Great Financial Crisis, retail and some smaller institutional investors were largely precluded from participating in this market (aside from being able to invest in high-yield mutual funds). Therefore, the private debt markets were largely for banks and large institutional investors. At the same time, the size of companies that could raise money from the likes of U.S. private placements, mezzanine funds and the growing leveraged loan market (with the latter fuelled by the proliferation of CLOs) were mid-to-larger sized companies, with smaller companies obtaining no benefits just yet from the expanding private debt market.

The Great Financial Crisis Spawns Evolution

The Great Financial Crisis in 2007-2009 was the deepest recession since the Great Depression. Yet even with a recession and its many lasting negative effects on all aspects of the financial world (and beyond), one benefit that emerged is how it led to further growth and evolution in the private debt market.

The Great Financial Crisis was essentially born out of a debt crisis in which banks were caught holding too much correlated risky debt that they could not syndicate as the capital markets seized up. The crisis exposed the systemic risk of a fragile and interconnected U.S. banking system.

This crisis also led to the adoption of a variety of new regulations to greatly reduce the likelihood of this sort of crisis from occurring in the future. One of the key regulatory acts was the Dodd-Frank Act, and pursuant to this legislation, the Volcker Rule, which required banks to risk-weight their assets. This meant that riskier loans would carry substantially higher capital costs. Risk-weighting and other new banking regulations greatly reduced risky lending by banks, meaning that the U.S. banking system was safer and better capitalized. Yet the new regulations and higher capital requirements meant that banks were often less willing (than before the Great Financial Crisis) to lend to small- and medium-sized non-investment grade companies, freezing these companies out of the debt markets.

As banks curtailed their lending to smaller companies, the door opened for the growth of private debt funds to provide direct lending to companies. Debt funds focused on direct lending were not the only strategy that saw strong growth post-Great Financial Crisis, as funds also proliferated focused on other strategies like special situations/distressed debt; venture (early stage) debt; real estate debt/mortgages; infrastructure debt; and asset-backed debt of more esoteric assets like trade receivables.

Direct non-bank lenders (primarily consisting of private credit fund managers) have focused on providing debt capital directly to non-investment grade companies. In most cases, this debt was senior and secured by hard assets. Eventually, so-called unitranche debt came into existence, which was senior secured debt and mezzanine debt rolled into a large single structure, with the return target being a blend of the return on senior secured and mezzanine debt. Direct lending funds targeted small and middle-sized companies, but also private equity firms — especially those focused on smaller leveraged buyouts in which banks might have more conservative underwriting requirements in comparison, while the high-yield market was not a financing alternative due to minimum issue thresholds.

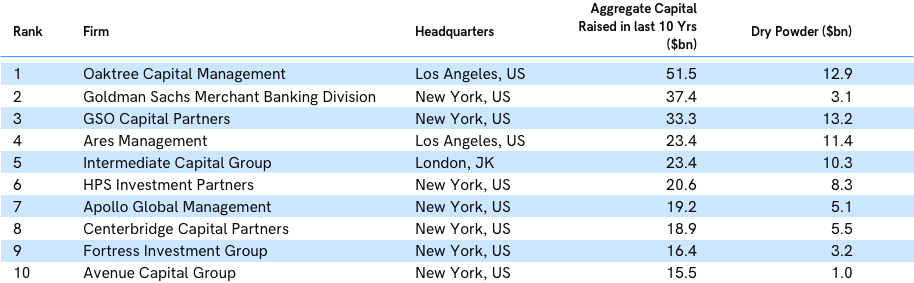

As independent credit funds proliferated, more well-established institutional asset managers began focusing on the strategy and raised direct lending funds to capitalize on the attractive returns from lending to small- and medium-sized companies. Amongst the larger and better-known independent private debt funds are listed in a 2018 report from Preqin below:

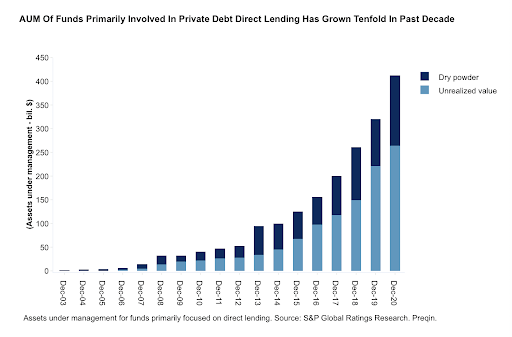

The chart below illustrates the growth of direct lending funds in the U.S. since 2010.1

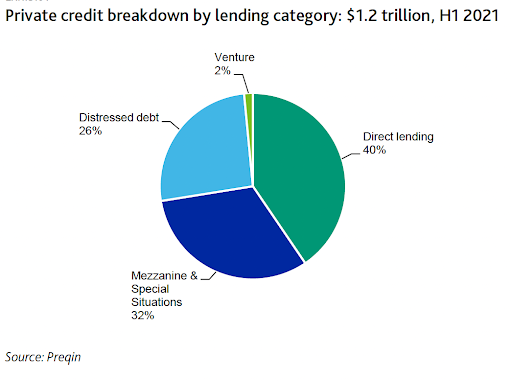

Of the total debt fund market of an estimated $1.3 trillion, direct lending is the fastest-growing strategy and accounts for 35% to 40% of all private debt fund activity.

The chart below from Moody’s Investor Services (“Private Credit Expansion Fuels Asset Managers’ AUM Growth”) illustrates the AuM by strategy of debt funds.

Pension funds and insurance companies are increasingly allocating their AUM to private credit funds as a compliment and alternative to their existing investment portfolios which tend to be invested principally in the public investment-grade debt and the public equity markets.

To read the final part in this series on the History of Private Credit, click here.

1Source: S&P Global report “Private Debt: A Lesser Known Corner of Finance Finds The Spotlight”.