August – often a low volume and unexciting end-of-summer month in financial markets – was much more volatile and eventful than usual this year, with the excitement stemming principally from global central banks as they try earnestly to curb stubbornly high inflation. Even as central banks were tightening the screws, August didn’t start off badly for equities, which registered strong gains for the first half of the month.

- The S&P 500 was up 4.2% in the first two weeks of August following a strong performance in July. The benchmark U.S. index had increased over 17% since mid-June, recovering from a dismal first half of the year.

- However, there were plenty of doubters who were trying to talk down the rally, and to be fair, there were plenty of warning signs on the horizon.

In retrospect, it had simply become a matter of “too much, too fast”, a narrative that eventually shifted momentum mid-month as sentiment slowly began to worsen and support for stocks eroded.

- Equities started sliding on August 17th, and the downward slide was accelerated following Federal Reserve Chair Jerome Powell’s 9-minute speech at the Jackson Hole Economic Symposium on August 26th, which you can watch here.

- Equity investors were holding out hope that they might see some sign, however subtle, of Federal Reserve capitulation, but it was not to be. Mr. Powell, in fact, made it crystal clear that inflation was the only priority for the Federal Reserve at the moment, effectively shutting the door on investors’ hopes for a Federal Reserve pivot.

- Both the stock and bond markets took this news poorly. The S&P 500 plunged following Mr Powell’s speech, and Treasury yields increased. The S&P 500 ended down 3.4% on that day to end the worst session in months.

Mr. Powell’s hawkish comments were followed by a combination of similarly hawkish comments from other Federal Reserve officials, as well as strong jobs data and consumer confidence readings, validating the Federal Reserve’s aggressive tightening policies as it tries to tame inflation.

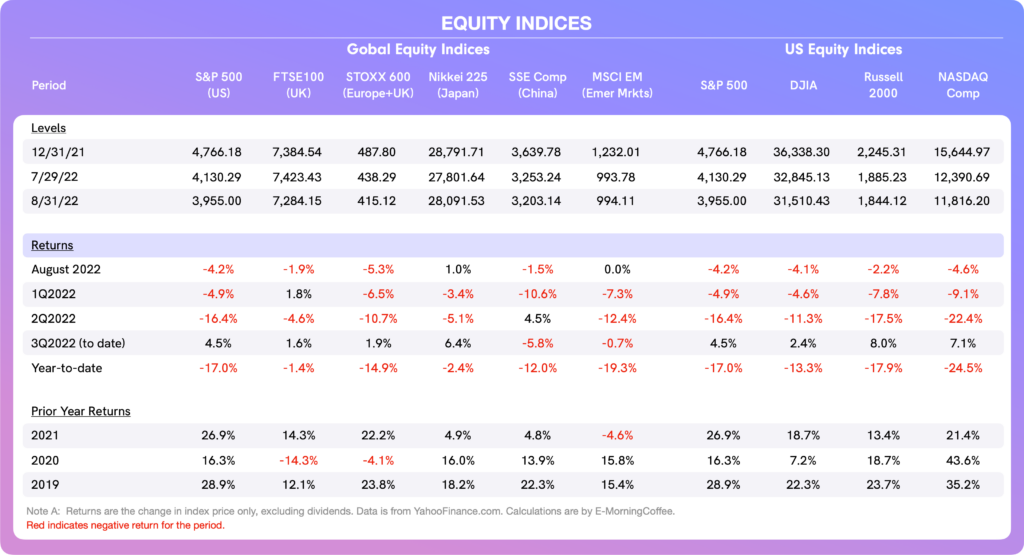

All of the U.S. equity indices that we track, as well as the U.S. Treasury total return bond indices (7-10 years and 20+ years), ended August in the red, offsetting a portion of the gains since the mid-June lows, but perhaps more detrimentally, setting a sour tone as we begin September.

- The damage was not only in U.S. equities, as rising inflation and the expectation of tighter central bank policies in the U.K. and the Eurozone also pushed stocks and bonds lower in these economies.

- The only market that we track that was in the black for August was the Nikkei 225 (Japan), with the European equity market index (STOXX 600) being the poorest performer for the month.

- Credit improved during August, with spreads tightening in both investment grade and high yield. However, the direction of travel in the last week of the month was towards wider credit spreads and higher yields.

- Gold and oil were both down in August, too.

- Similar to equities, Bitcoin also declined in August, down 15.8% on the month to end at $20,050, following a solid July and hopes that the “crypto winter” might be behind us. Now, it is not so sure.

One of the biggest culprits that continues to affect markets is the strong U.S. Dollar. The U.S. Dollar had come off its highs of mid-July and looked to be settling at a lower range when July ended, but August saw a reversal of direction as the U.S. Dollar steadily increased throughout the month. The knock-on effects of a strong U.S. Dollar are evident in the market, some direct and others indirect.

- The U.K. Pound fell below $1.17/£1.00 level, and the Euro declined to, and then remained around, parity with the US Dollar, a level (for the Euro) not seen since November 2002.

- Many U.S. companies discussed the negative effects of a strong U.S. Dollar when they reported their 2Q22 results in July and early August, and now there is reason to fear that top-line results and operating margins for 3Q22 will continue to be negatively affected by the strengthening greenback.

- A strong U.S. Dollar also means that developing economies with currencies tied to the Dollar face higher import prices (meaning the U.S. is exporting inflation), and that companies located in these countries will find the global marketplace less receptive for their products as the prices of their exports increase. Obviously, neither is good for Dollar-linked emerging markets countries.

The correction in equities was not unexpected, both as valuations were improving too quickly against generally mediocre earnings and investors were overly optimistic that the Federal Reserve would show some mercy as higher interest rates start to bite. The litany of risks articulated in last month’s Percent Market Insights remain on the table, and September might very well prove to be just as volatile and challenging.

All eyes will certainly be focused on central bank meetings scheduled for September, with monetary policy meetings and rate decisions on the table from the Federal Reserve, the Bank of England and the European Central Bank. These meetings will take place as follows (with current overnight bank rate and consensus expectations regarding September rate rises in brackets):

- European Central Bank – September 8th (0% now, consensus +0.50% – 0.75%)

- Bank of England – September 15th (1.75% now, consensus +0.50%)

- Federal Reserve – September 20th-21st (2.25%-2.50% now, consensus +0.50% – 0.75%)

As we will probably see first-hand in September, central banks in the U.S., U.K., and Eurozone are firmly digging in their heels to address stubbornly high inflation, with various shades of acknowledgement about the pain this will inflict as far as slowing economic growth and rising unemployment. The Federal Reserve will also double the amount it is shrinking its balance sheet starting in September, from $47.5 billion/month (June to August) to $95 billion/month across U.S. Treasury securities and mortgage-backed securities. This will likely put further upward pressure on yields at intermediate and longer maturities.

There may not be a central bank pivot in any of these economies, with the European Central Bank arguably having the biggest challenge in the common currency zone.

- Energy prices are set to continue to increase, especially gas prices in Europe as Russia toys with its dependent neighbors to the west as winter approaches.

- China is going the other direction as far as its monetary and fiscal policies, trying to stimulate an economy that has slowed sharply as the year has progressed for a variety of reasons.

- As western economies try to address stubbornly high inflation by raising interest rates, and China’s economy – the second largest in the world – slows, the foundation for risk assets does not look solid as we move into the autumn.

Asset Class Performance

Equities: After an encouraging July and start to August, U.S. equities began to fade in the second half of the month, eventually reversing earlier gains and causing all four of the U.S. equity indices we track to end August in the red.

- As has been the case throughout much of the post-pandemic period, higher bond yields most perversely affected the NASDAQ, which is more skewed towards high-tech companies that are more interest rate sensitive.

- For international equities, the only index that was positive in August was the Nikkei 225 (Japan), while the STOXX 600 (Europe) had the worst return. All of the indices we follow are negative YtD as we end August, with a negative bias suggesting further weakness in global equities ahead.

August 2022 Global and U.S. Equity Indices (A)

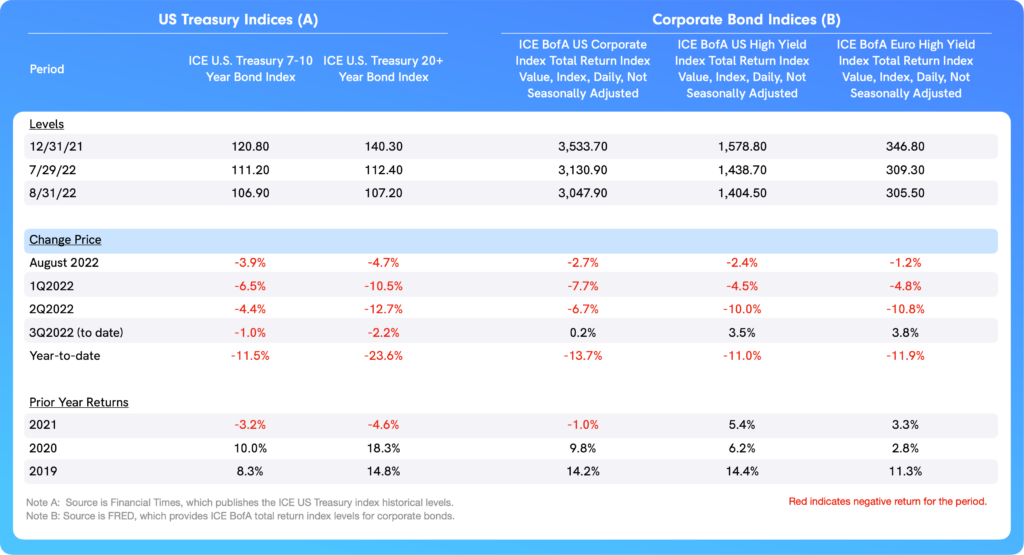

Bond Yields: U.S. Treasury yields reversed their improvement in July as yields headed higher throughout much of August, as you can see in the table below.

August 2022 U.S. Treasury and Corporate Bond Yields / Spreads (A)

- The yield increases, significant across the curve, were most severe at the short end of the U.S. Treasury curve, with the two-year UST yield increasing 0.56% in August and the 2-10 year yield curve steepening a further 8bps to negative 30bps by month end.

- As August wore on, it was becoming increasingly clear that although the U.S. might have seen peak inflation, getting inflation back to the Federal Reserve’s target of 2% would take an ongoing and potentially long-lasting series of policy moves involving progressively higher interest rates.

- Federal Reserve Chairman Powell and a host of other Federal Reserve presidents and governors have made it increasingly clear with more conviction than in the past that the Federal Reserve would continue to tighten the screws, and this sent yields higher across the board.

- The negative 2-10 year yield curve is often a harbinger of a pending recession, although the post-pandemic cycle has been manipulated by unconventional fiscal and monetary policies that can make it more difficult to reach this conclusion with certainty.

Corporate Bonds: Corporate bond yields and spreads also reversed their directional moves and started to widen in the latter half of August, across both investment grade and high yield.

- Credit spreads still remain well inside their 2022 highs reached in mid-June, although there is certainly risk that as underlying yields increase and the economy slows, the effect on corporate borrowers will be felt more severely, pushing credit spreads wider.

August 2022 U.S. Treasury and Corporate Bond Total Returns (A,B)

Bond Total Returns: After hopes that the July trend towards gains in bonds would continue into August, the reality is that investors incurred further losses in both U.S. Treasuries and corporate bonds in August as yields increased.

As a reminder, the positive correlation between U.S. equities and U.S. Treasuries is unusual, with both traditional asset classes down sharply during 2022.

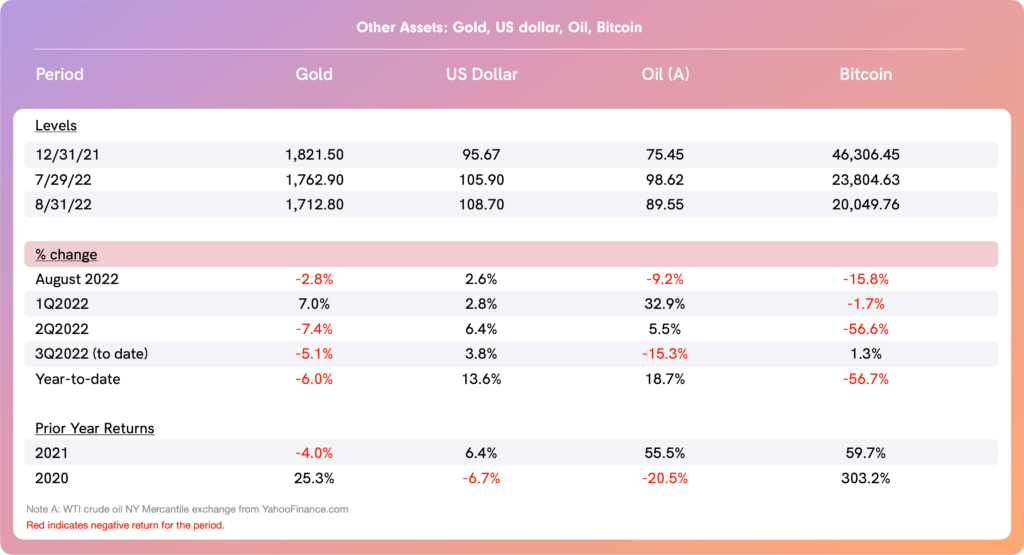

August 2022 Other Asset Classes: Gold, U.S. Dollar, Oil, Cryptocurrencies

Gold: The price of gold was down 2.8% in August, extending the YtD loss to 6.0% in an asset class that many consider to be the ultimate store of value.

U.S. Dollar: The U.S. Dollar trended higher again in August to close the month at USD 108.70 / USDX 100, making this the third consecutive month that the Dollar has strengthened.

- August registered one of the largest monthly increases in the USD this year (+2.6% MoM).

- As a reference point, the average U.S. Dollar / USDX index since the beginning of 2018 has been around USD 96 / USDX 100.

- The U.S. Dollar ended August near its highest level in around 20 years, another sign that at these levels, the Dollar is probably due a correction.

Oil: The price of WTI crude oil continued a decline which started in mid-July, trading most of the month in a range of $86/bbl to $97/bbl but ending August down 9.2% at $89.55/bbl.

- Slower global economic growth suggests that oil prices should continue to decline, but dislocations related to sanctions on Russian oil and gas – and potential actions by OPEC+ – will likely continue to underline prices around the $90/bbl level.

Cryptocurrencies: It appeared that we had moved beyond the worst days of the latest crypto winter in early July, but the second half of August brought weakness in cryptocurrencies back to the forefront.

- The price of benchmark Bitcoin fell briefly below the $20,000 level in late August, before bouncing to close the month at $20,050 (– 15.8% MoM).

- Bitcoin and its crypto brethren remain one of the worst performing asset classes YtD, with Bitcoin down nearly 57% for the year.

Key Sentiment Drivers

Jackson Hole Economic Symposium: Chairman Powell stood his ground as he addressed the audience in Jackson Hole on August 26th, providing no glimmer of hope that the Federal Reserve would reverse course as far as seeing off inflation, even acknowledging that there would be pain ahead.

- U.S. equities sold off on the news, as did U.S. Treasuries, with yields heading higher more severely at the short end of the curve.

- The 2-10 year yield curve became more inverted, worsening in the half week following Mr Powell’s comments and ending the month at negative 30bps.

Student Loan Forgiveness (U.S.): President Biden announced on August 24th that his administration would forgive up to $10,000 of student loan debt for each person making under $125,000/year and would extend the repayment moratorium for student loans – set to expire this month – until the end of the year.

- For more details on this, view The Fact Sheet from the White House.

- There are plenty of arguments from economists and investors against this legislation, mainly related to whether or not it is fair, and concerns about the incentives it might introduce (i.e. moral hazard arguments).

- Student loan forgiveness is a form of fiscal stimulus which is inflationary, and the loan forgiveness does nothing to address the issue of skyrocketing university tuition in the U.S.

- Various sources put the cost of the student loan debt forgiveness program at between $300 billion and $500 billion. For context, 43 million Americans have student debt totaling around $1.6 trillion, and one-third of people with student debt have balances less than $10,000.

Inflation: CPI for July was released in early August for the U.S. and U.K.

- CPI fell in July in the U.S. to 8.5%/annum (YoY), an improvement from 9.1% in June but still very high by historical standards.

- July showed a nil increase in inflation, positive news although the labor market remains very tight in the U.S.

- CPI in the U.K. increased to 10.1%/annum in July, up from 9.4% in June.

- Eurostat released flash inflation for August for the Eurozone on August 31st, and it too showed an increase in inflation in the common currency bloc to 9.1%/annum, up from 8.9%/annum in July. Europe is more perversely affected than the U.S. by higher natural gas prices due to the Ukraine-Russia conflict.

- These inflation readings across the board make it almost a certainty that the Federal Reserve, Band of England, and European Central Bank will need to be increasingly aggressive to get inflation back to the 2% target in the coming months or years.

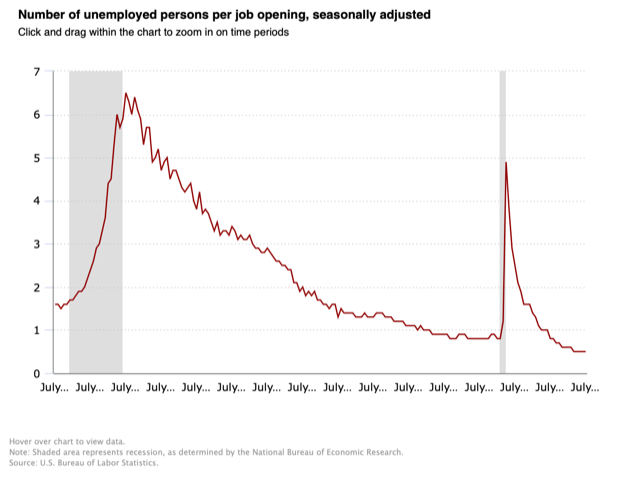

U.S. Jobs: The JOLTS (“Jobs Opening and Labor Turnover Survey”) for August, released on August 30th, showed no change in job openings in the U.S. for the month, which remained at 11.2 million.

- As you can see in the table below, there is only around one half of an employee for each available job opening in the U.S., reflecting a labor market that remains incredibly tight in spite of the hawkish measures being undertaken by the Federal Reserve.

- With July unemployment at 3.5% (August pending) and 5.7 million unemployed Americans, it is clear that inflation will not be easy to bring down in the U.S. without significantly more monetary tightening, which in turn will continue to wreak havoc on risk assets as economic growth slows and unemployment rises.

This newsletter was written in partnership with Tim Hall of EMorningCoffee.com. For more insights and other market learnings, subscribe to E-Morning Coffee today.