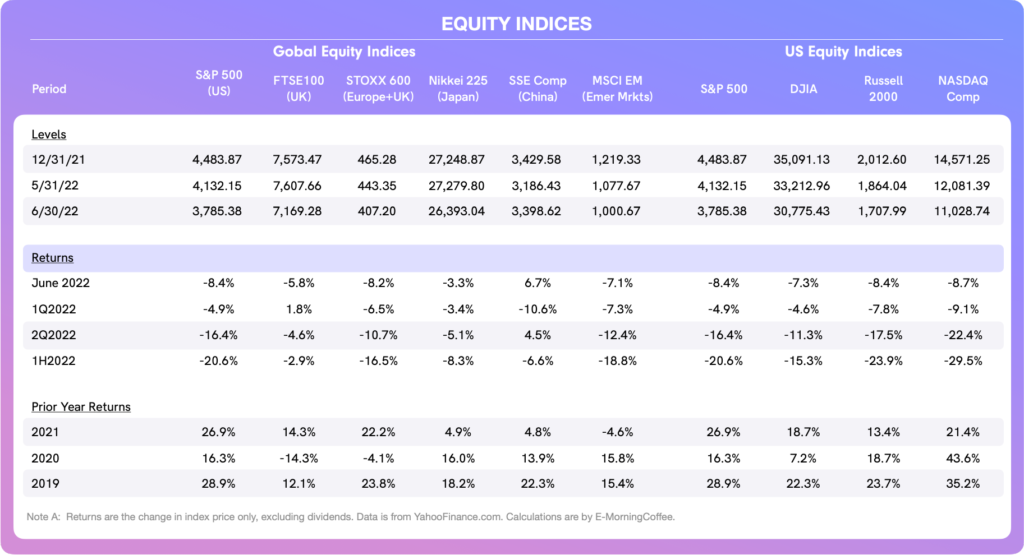

Thursday marked the end of a difficult first half of the year for nearly all traditional financial asset classes. For the past six months, returns in most global equity markets were negative, with U.S. equities being one of the poorest performers.

- The S&P 500 declined 20.6% in the first half of this year, its worst first half year return since 1970.

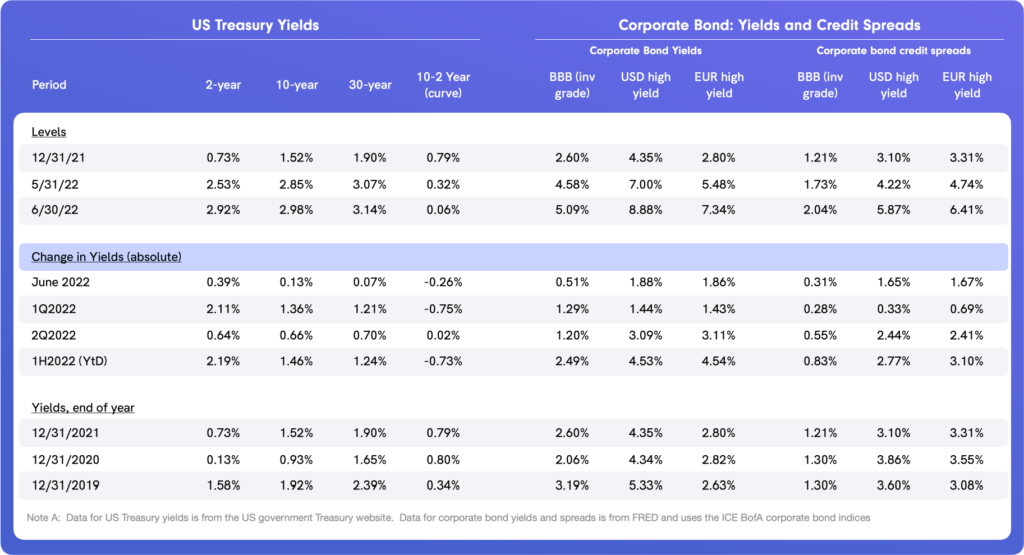

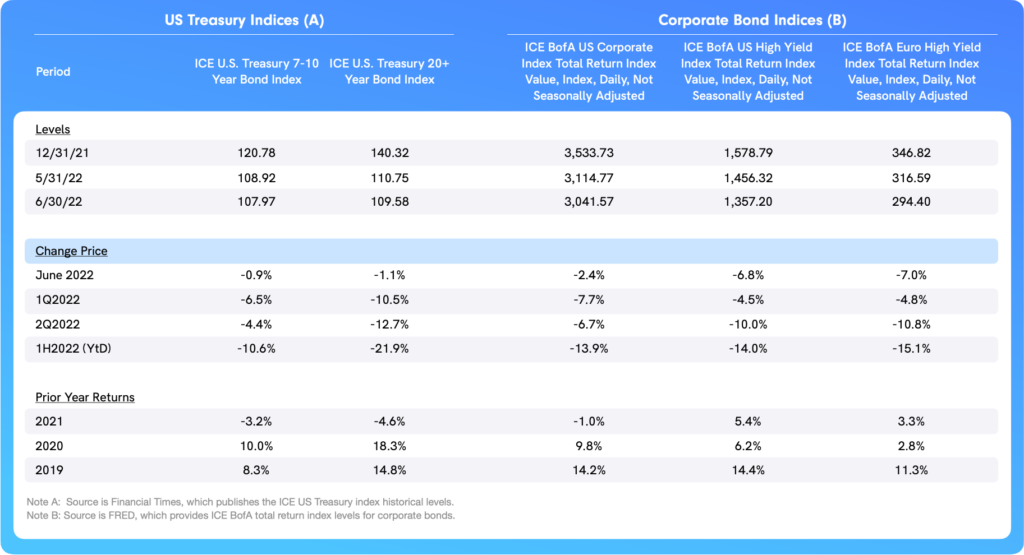

- Normally, U.S. Treasuries are negatively correlated with equities, meaning that the prices of U.S. Treasuries increase as the prices of stocks decrease. Yet the highest inflation in over 50 years in the U.S. negatively affected bond prices as yields rose throughout the period (causing prices to fall), occurring at the same time that stock prices also declined.

- The ICE U.S. Treasury 20+ year bond total return index was down 21.9%, an even worse performance than the S&P 500.

- The usual safe haven destination for investors moving money out of the stock market is U.S. Treasuries, but U.S. Treasuries offered no solace to investors.

Even as most significant traditional assets classes lost further ground in June, two positives during the month were:

- U.S. Treasuries reached an inflection point mid-month, and yields declined since then.

- The Shanghai Composite rose a solid 6.7% in June, albeit returns on Chinese stocks remain negative year-to-date.

As far as other financial assets, corporate bond yields and credit spreads widened in June for both investment-grade and high-yield bonds as prices of corporate bonds tumbled.

- Gold and oil prices were lower, and the U.S. Dollar strengthened, hovering near record highs.

- Cryptocurrencies remain under severe pressure and experienced sharp price deterioration, claiming several victims (stable coins and hedge funds) along the way.

- The once-risk-tolerant crypto investor class was, like with other assets, spurred by increasingly hawkish central bank policy actions necessary to address rising inflation, and fears that this tightening will slow global economic growth or even push economies into recession.

Performance of Asset Classes

Equities

The U.S. had the worst performing equity market in June, and U.S. equity indices are the worst performing equity indices year-to-date. The pain was most severe in the NASDAQ Composite, arguably the most interest rate-sensitive of the U.S. indices given its weighting towards technology companies.

June did have one bright spot as far as global equity indices, which was the Shanghai Composite.

- Chinese equities were negatively impacted for months now, first by government crackdowns on Chinese technology companies, and then by periodic wholesale lockdowns in large cities to combat the spread of COVID.

- Chinese equities are also inexpensive compared to equity markets in most developed countries.

- As COVID lockdowns eased, investors warmed to Chinese stocks again, pushing the Shanghai Composite index to a solid 6.7% gain in June — the only index we follow that was green for the month and for the second quarter.

Bonds

Yields: During the first half of the month, yields continued to move higher as they have much of the year, driven by rising inflationary expectations.

- The yields on 2-year (more sensitive to the Fed Funds rate) and 10-year U.S. Treasuries both peaked around mid-June in the mid-3% area.

- Yields then began to decline, eventually falling back below 3% in the last week of June as concerns about a slowing U.S. economy overtook concerns regarding stubbornly high inflation.

Credit spreads in the corporate bond market – both investment grade and non-investment grade (i.e. high yield) – were sharply higher in June, very much in sync with the “risk off” sentiment in equity markets.

- There is no definitive sign that corporate credit is weakening, although it is not uncommon for high-yield investors to get in front of an economy that might be staring at a recession ahead.

- European high-yield credit spreads have widened, uncharacteristic for this smaller and generally more stable market.

- This reaction by European spreads can be justified by the more precarious position that the ECB finds itself in as far as reigning in inflation, Europe’s greater dependency on Russian oil, and its proximity to the conflict zone.

Total Returns

Total returns for both the ICE 7-year and the 20+ year U.S. Treasury bond indices were negative for June, though the recovery in yields in the second half of June softened the blow. Total returns in the corporate bond market were much worse than U.S. Treasuries, particularly in both U.S. and European high yield.

Assorted and Alternative Assets

Oil: The price of WTI crude oil declined 7.8% in June, the first month this year that oil prices have decreased.

- Issues around supply have not abated, but as concerns increase regarding a possible recession (which would adversely affect global demand), the price of oil seems to have stabilized in a range for the time being.

- The supply of Russian oil remains the significant wild card, given the ongoing conflict in Ukraine and western sanctions on Russian oil and gas.

U.S. Dollar: In spite of expectations that the U.S. Dollar might have peaked in May, the global reserve currency strengthened further in June, up 2.9% to $104.69/USDX1.00.

- The greenback is again nearing levels not seen since the mid-1980s.

- The U.S. economy remains in relatively better shape than the UK and Europe, although all three areas are fighting high inflation and face the risk of recession.

Gold: The price of gold was down 2.1% in June, reaping no benefits from the sell-off in risk assets as a safe haven.

Cryptocurrencies: Bitcoin declined for the third straight month in June (down 37.8%), bringing its loss for the first half of 2022 to 57.3%.

- Cryptocurrencies were initially rattled in May by some stablecoins losing their $1.00 price, remaining under pressure throughout June as investors moved out of cryptocurrencies more broadly and into other asset classes.

- The rapid and significant decline in crypto prices is adversely affecting many crypto hedge funds and brokers, especially those that were using leverage margin finance in their businesses.

Key Sentiment Drivers During May

Inflation

U.S. CPI for May was released on June 10th, coming in at 8.6%/annum. This was well above consensus expectations and an increase over April CPI of 8.3%/annum.

- The Bureau of Labor Statistics described the increase as “broad-based,” cutting across food, energy, services, and nearly all other categories monitored by the BLS.

- While May inflation surprised on the upside, the narrative in favor of the Federal Reserve’s hawkish policies slowly taming inflation but negatively impacting economic growth gained traction as June progressed.

- On the last day of June, the Bureau of Economic Analysis released U.S. personal consumption expenditures (PCE) for May), a figure more closely followed by the Federal Reserve as an indicator of inflation (since consumption is the key driver of U.S. economic growth). The data showed that real PCE fell by 0.4% in May, suggesting that inflation might have peaked and that the U.S. economy is likely slowing further.

Although inflation might have peaked in the U.S., it continues to increase in the UK and the Eurozone. UK CPI increased to 9.1% in May, an increase from 9.0%/annum in April. Flash inflation in the Eurozone for June was released late last week by Eurostat, coming in at 8.6%/annum, an increase over the May read of 8.1%/annum.

It is worth remembering that central banks can influence the demand side of inflation, but have little if any control over supply-push inflation resonating from high global oil prices and supply-chain disruptions related to COVID and Ukraine-Russia conflict.

Central Banks Respond to Inflation

The Federal Reserve raised the Federal Funds rate 75bps (to 1.50%-1.75%) and started its program of reducing its balance sheet. The 75bps increase was the largest increment since 1994. The Federal Reserve also revised its economic projections.

- The Bank of England raised the Overnight Bank Borrowing rate for the fifth time since December, to 1.25%, on June 16th.

- The ECB released a monetary policy statement on June 9th, leaving the bank borrowing rate unchanged. The ECB did announce that it would end quantitative easing on July 1st, and that a 25bps increase (to 0.25%) in the key overnight bank interest rate is almost a certainty for July. The Bank of Japan held its Monetary Policy meetings on June 16th and 17th, standing firm with its accommodative approach — one of the few dovish central banks in the world at the moment.

The Federal Reserve, Bank of England, and Eurozone all revised their economic forecasts for growth down in conjunction with their statements on monetary policy. This was an expected move given that all three central banks will be tightening policy considerably in the coming months to address inflation.

Global and U.S. Economic Growth

Both the World Bank and OECD revised their forecasts for global growth down in June.

- The World Bank revised 2022 growth down to 2.9% from an earlier forecast of 3.2% (in April).

- The global economy grew 5.7% in 2021, so 2.9% projected growth for 2022 represents a sharp deceleration in global growth.

- Similarly, the OECD revised its outlook for global growth to 3.0% for 2022 (down from 4.1% in its January 2022 outlook), and its outlook for the following year (2023) is for 2.8% growth.

- The 2.8% projected for 2023 compares to 3.0% projected by the World Bank for 2023. You can find the World Bank’s most recent “Global Economic Forecasts” here, and the revised OECD “Economic Outlook June 2022” outlook here.

In the U.S. on Friday (July 1st), the Federal Reserve Bank of Atlanta released its revised forecast for second-quarter GDP. The forecast for 2Q22 GDP is now a decline of 1.0% for the quarter, whereas on April 29th the forecast for 2Q22 GDP was for growth of 1.9%.

- Since GDP for 1Q22 for the U.S. was negative 1.6% , if real GDP growth were to be negative in the second quarter, it would mean that the U.S. is already in a technical recession.

- Pundits and investors are increasingly flocking to this camp, as bond prices signal that the U.S. has passed peak inflation and economic growth is expected to slow further.

This newsletter was written in partnership with Tim Hall of EMorningCoffee.com. For more insights and other market learnings, subscribe to E-Morning Coffee today.