Percent Market Insights: June 3, 2022

A Perfect Storm of Volatility

Sentiment during the first three weeks of May felt similar to April as the ongoing “risk-off” attitude caused equities and bonds prices to continue to slide. As it had broadly telegraphed, the Federal Reserve dug in its heels and remained singularly focused on tightening monetary policy quickly in order to snuff out surging U.S. inflation.

May earnings from S&P 500 companies further heightened investor anxiety with wage inflation and on-going supply-chain disruptions eroding margins of some companies, raising concerns about the trajectory of future earnings that underlay heady valuations. Investors are also concerned that the Fed might overshoot in its tightening tactics, leading to potential demand destruction.

- In the second week of May, oil broke out of its recent narrow trading range and the price marched higher, while the U.S. Dollar ended its nearly 12-month surge and began to weaken.

- U.S. Treasury yields also came off their early-May highs and the yield curve steepened.

- Corporate credit rallied during May, moving in the same direction as equities which suddenly found their mojo towards the end of the month, with the S&P 500 surging 6.6% on the Friday before the Memorial Day weekend.

- The one asset class not participating in the late-May rally – at least so far – is cryptocurrencies, which remain under severe pressure.

How Asset Classes Performed

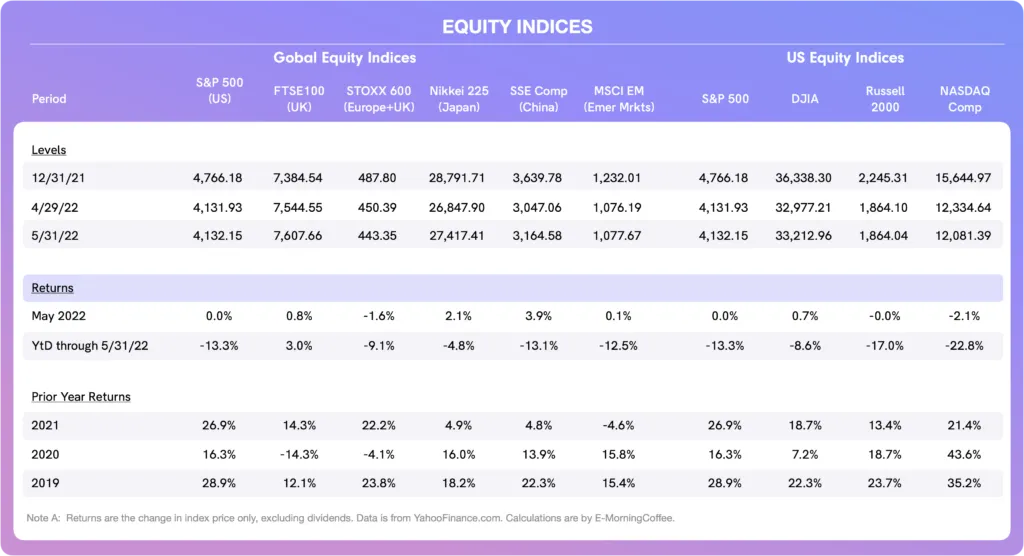

Equities: Although May was not a complete washout for U.S. equities, it took a sharp single-day rally near the end of the month to salvage a flat (S&P 500, Russell 2000) to positive (DJIA) month for three of the four U.S. indices.

- Until the final week of May, the S&P 500 had declined for seven consecutive weeks.

- Even with the late May surge, the tech-heavy NASDAQ was unable to claw back its sharp declines for the month and remains – by a significant margin – the worst performing U.S. equity index for May (down 2.1%) and YTD (down 22.8%).

- Globally, equity returns were mixed in May, with the Shanghai Composite (China) delivering the best return for equity investors during the month and the STOXX 600 (Europe) delivering the worst.

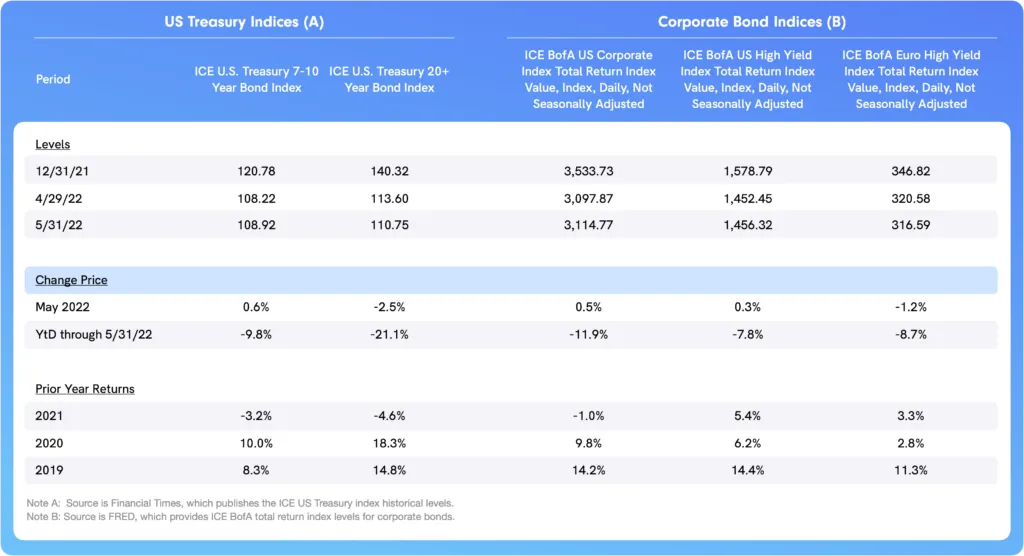

Bond Yields: U.S. Treasury yields were lower in May after reaching a peak in the first half of the month.

- The yield on the 2-year UST declined the most, decreasing 17bps from its high on May 3rd to end May yielding 2.53%.

- The yield on the 10-year UST also declined, but not as much as the 2-year, meaning that the yield curve steepened (2-10 years) from 19bps at the end of April to 32bps at the end of May.

- Credit spreads in the corporate bond market – both investment grade and non-investment grade (i.e. high yield) – stabilized and then fell sharply the last 10 trading sessions of May, suggesting that investor sentiment, as far as risk, was slowly improving. USD-denominated high yield spreads declined from 4.92% on May 19th to 4.22% on May 31st.

Total Returns: The 7-10 year total return for the U.S. Treasury index finally moved into positive territory in May for the first time this year. During much of May, investors seemed to relegate inflation fears as they moved out of stocks (which were under intense pressure most of the month) and into the safe haven of U.S. Treasuries.

- Remember that price action in the bond market is the inverse of yields. As the prices of U.S. Treasuries stabilized and then improved, the traditional negative correlation between equities and bonds (i.e. stocks up, bonds down) was re-established in May, although this might prove to be temporary.

- USD-denominated investment-grade and high yield corporate credit eked out positive returns in May, while European high yield could not fully overcome the sell-off experienced in the first half of the month and had a negative total return for the month.

- Even with slightly better performance in May, the total returns on U.S. Treasuries, investment grade corporate credit and high yield remain negative YTD. The long end of the U.S. Treasury curve (20+ year index) has been the most perversely affected, not surprising given the long duration of this index and direction of yields so far this year.

Assorted Asset Performance

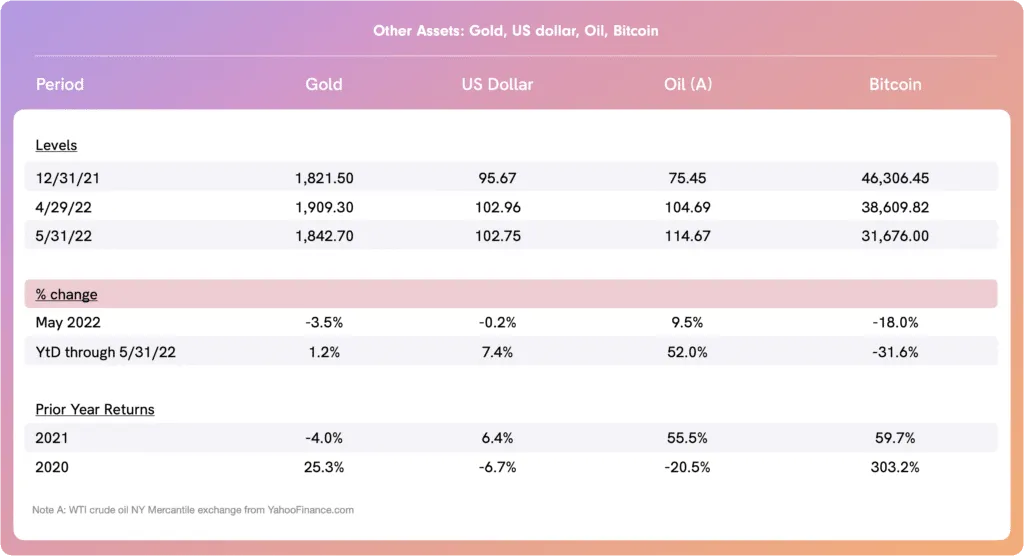

Oil: Oil has been closely watched because it is at the center of the sanctions against Russia. The price of oil rose 52% since the beginning of this year, with almost half of this increase occurring since Russia invaded Ukraine on February 24th.

- The price of WTI crude oil moved out of its recent $95-$105/bbl trading range in May, increasing sharply the last few trading sessions of the month to end at $114.67/bbl.

U.S. Dollar: The U.S. Dollar has steadily strengthened since May 2021, reaching a peak of $104.85/ USDX1.00 on May 12th, its highest since around 1986 due to a confluence of factors. Investors generally believe that at this level, the greenback is overvalued. Since early May, the U.S. Dollar has weakened.

Gold: The price of gold is up 7.1% YTD but declined 3.5% in May, as inflation is believed to have peaked and investors returned to risk-assets like equities in the final days of the month.

Bitcoin: As far as cryptocurrencies, Bitcoin has decoupled from equities and was down 18% in May, bringing its year-to-date loss to 32%. Cryptocurrencies have been heavily affected by concerns mid-month with some of the algorithmic-based stable coins losing their $1.00 price, with the most notable casualty being Terra USD (Luna).

Key Sentiment Drivers in May

U.S. Economic Data: There were no material surprises as far as U.S. economic data released this past month, as the economy remains sound but inflation is running at unsustainably high levels.

- 428,000 jobs were added to the U.S. labor force in April, and unemployment fell to 3.6%, according to the BLS jobs report released in early May. The number of unemployed fell to 5.9 million, compared to 5.7 million unemployed in February 2020, prior to the pandemic.

- The labor market is arguably at or near full employment, a remarkably fast recovery since the darkest days of the pandemic. Good news as far as full employment and solid U.S. economic growth has become bad news for inflation.

- The BLS released its April inflation report on May 11th, and CPI for April came in at 8.3%. This was a slight decline from 8.5% in March but was still above economists’ consensus expectations.

- Last Friday, the Bureau of Economic Analysis (BEA) released personal consumption expenditures (PCE) for April, a much-monitored statistic by the Federal Reserve (see here). Similar to CPI, PCE also showed a slight decrease in April, falling to 6.3% (from 6.6% in March). In essence, this data suggests that U.S. inflation probably peaked in March.

- The question now is not if inflation will decline as the Fed rachets up rates, but rather how long it will take to reach the Fed’s 2%/annum target and what will be the cost (in terms of lost jobs).

Earnings: Most of the S&P 500 companies have now announced their first quarter earnings. Although the majority of S&P 500 companies beat top- and bottom-line analysts’ consensus expectations, the results from technology companies and select U.S. retailers were mixed. The misses weighed heavily on sentiment across U.S. equities, as these misses (or negative revisions to forward guidance) caused companies’ share prices to be battered badly.

Technology companies' earnings:

- Many e-commerce and related names (including Shopify (SHOP), Etsy (ETSY) and E-Bay (EBAY)) disappointed in terms of earnings and also revised their forward guidance down for the full year. Although it did not release earnings, Snap Inc (SNAP) filed an 8-K also revising its 2022 outlook down.

- The issues experienced by these mid-size tech companies are not dis-similar to those highlighted in April by tech giants Meta Platforms (aka Facebook, FB) and Alphabet (aka Google, GOOG). Large or small, all of these companies reported that advertising revenues were under pressure and would be less than originally thought for the full year.

- Coinbase (COIN) also disappointed in May, as lower cryptocurrency prices and a decline in transactions pushed this cryptocurrency brokerage company to a loss in 1Q2022.

- Towards the end of May, Nvidia (NVDA) also released its 1Q2023 results (quarter ended April 30, 2022), which were better than expected in terms of both revenues and earnings. However, similar to many other tech companies, Nvidia revised its full year guidance lower, too, with the major culprit being supply-chain disruptions.

Select retail companies earnings: The bottom-line misses by both Walmart (WMT) and Target (TGT) on consecutive days in mid-May shocked investors, sending the shares of both companies sharply lower.

- On the surface, you might be thinking that these are not the type of retailers that would suffer from a gradually slowing U.S. economy as things normalize post-pandemic. However, both companies highlighted escalating operating costs that they were unable to fully pass through, including higher transportation and wage costs (wage inflation + too many legacy-pandemic workers), and on-going supply-chain disruptions.

- These factors caused an unexpected increase in operating costs, pushing down profits even as both companies had decent top-line and same-stores sales growth. Both companies also guided analysts lower as far as FY earnings. Perhaps Amazon’s poor quarter should have served as a harbinger.

- Ross Stores (ROST) and Kohl’s (KSS) also missed analysts’ expectations and revised their 2022 guidance downwards, with shareholders paying the price. The retail ETF index XRT was down 5.8% for the month of May.

The Federal Reserve: The Federal Reserve increased the Federal Funds rate by 50bps on May 4th, to a range of 0.75% - 1.00%. This followed a 25bps increase in March, as the Fed tries to tamp down surging inflation.

- The Fed is forecasting six additional rate rises before the end of the year, with the Federal Funds rate expected to reach 3.00% - 3.25% by then.

- Last Wednesday (May 25th), the minutes from the Federal Open Market Committee (FOMC) meeting were released. The Fed articulated its ongoing concerns about inflation and highlighted that the U.S. economy – and particularly the labor market – remains very robust. The minutes suggest that if things continue on this trajectory, the Fed is likely to implement at least two more 50bps increases in the Federal Funds rate during the next two FOMC meetings (the next one of which is June 14-15).

- In addition, the Fed will start reducing its balance sheet (i.e. quantitative tightening) on June 1st by not fully reinvesting the proceeds of maturing USTs and MBS.

Global Markets: The Bank of England raised its overnight bank borrowing rate in early May for the fourth time since December. Inflation is surging in the U.K., with the BoE expecting inflation to reach double digits by 4Q2022. With its (sole) mandate to reduce inflation back to 2%, the central bank will continue to raise rates even though it expects the U.K. economy to shrink in both the 4Q22 and 1Q23 as the country moves into a recession.

The European Central Bank, which has been slower to act than the Fed and BoE, turned more hawkish as the month wore on. Early last week, ECB President Christine Lagarde suggested that the ECB would consider raising the overnight bank rate as soon as July and would end its quantitative easing program to address rising inflation in the Eurozone.

- These comments helped the Euro steady vis-à-vis the U.S. Dollar, as the currency had been losing ground all year.

- The more hawkish tilt of the ECB was not surprising since Eurozone flash CPI for May, released by Eurostat (here) on May 31st, was a record 8.1%, up significantly from 7.4% in April.

- Other ongoing concerns include the Ukraine-Russia war and the global economic effects caused by widening sanctions on Russian exports, especially oil and gas, food shortages and transportation issues from Ukraine and Russia, and other supply-chain disruptions.

- COVID-inspired shutdowns in various cities in China also remain a concern, as they are contributing to supply-chain disruptions leading to cost-push inflation around the world.