Each month, the capital markets team releases an update that looks back at the previous month’s dealflow, while also highlighting the upcoming deal pipeline.

Please find Cadence’s Short Term Note Program (STNP) monthly market update for January 2021 below.

Market Commentary

During the month of December, with the U.S. Presidential elections behind us, we saw the market become increasingly focused on several factors: the timing and size of the U.S. stimulus bill, a rising COVID-19 case count and discovery of new variants of the disease, and new restrictions and curfews being implemented across Europe and Latin America to curtail rates of infections during the holiday season. All of this happened amid the initial stages of the vaccine rollout globally.

Despite no major implications on market performance, we also saw the signing of a long-awaited Brexit deal between the U.K. and the European Union. We also observed during this period a slide in the value of the U.S. dollar, which in turn pushed commodity prices higher and helped drive select cryptocurrencies valuations through their record 2017 highs.

During the last weeks of the month — and as the number of new COVID-19 cases and daily deaths hit new records — the US House of Representatives approved an increase in stimulus payments raising pressure on the Republican-controlled Senate to expand the $900 billion economic relief package. The vote in the lower chamber of Congress echoed the push for larger checks by Donald Trump, who signed the relief bill on the last Sunday of the year. The relief package also includes more immediate help in the form of small business loans, PPE distribution and virus testing funds, and extends unemployment benefits through mid-March. The Senate on Friday did not have an opportunity to vote on increasing the size of the payment from $600 to $2,000, but this will likely be re-assessed in January.

Looking at the equity markets, the Dow Jones, which in November had its best monthly performance since January 1987, rose ~2.6% in December. The S&P 500 also posted 2.6% gains for the month, whereas the NASDAQ had a more significant increase, posting 4.3% gains. As volatility was generally subdued this month, we saw the VIX index remain low, with a slight increase from 20.8 points at month open to 22.7 points for month close. On the fixed income side, we also saw little variability in the 5-year and 10-year benchmarks ending December at 0.36% and 0.93%, respectively, logging a 6bps decrease and 1bps increase, respectively, since November’s close.

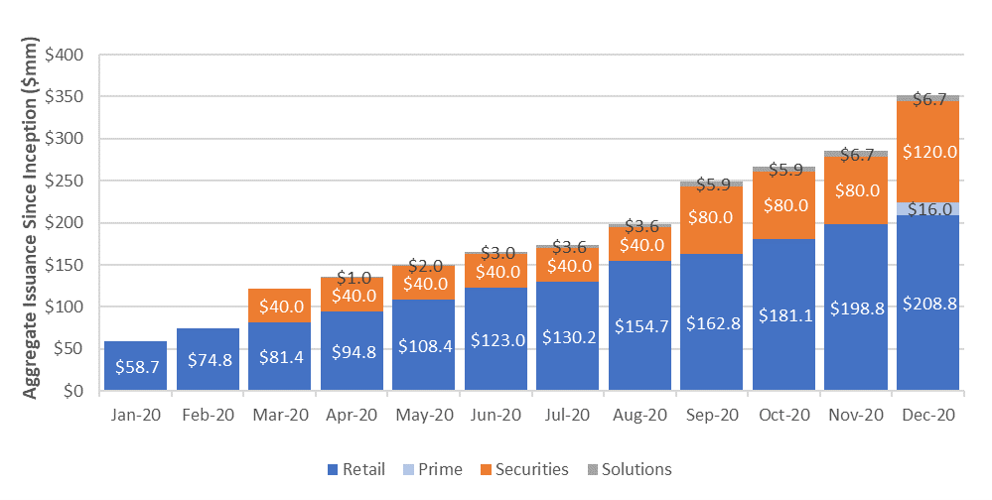

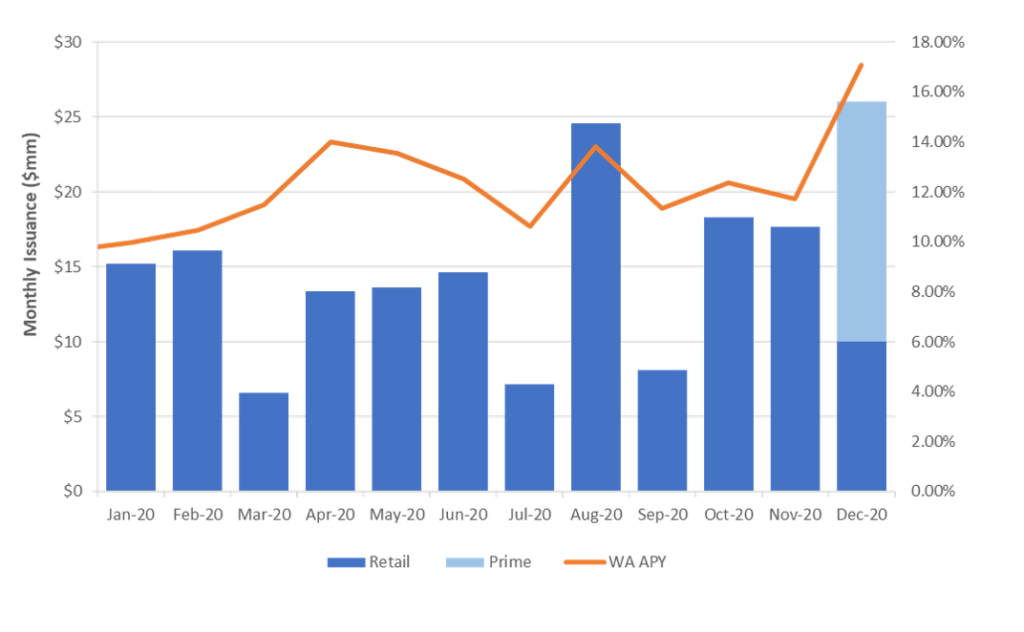

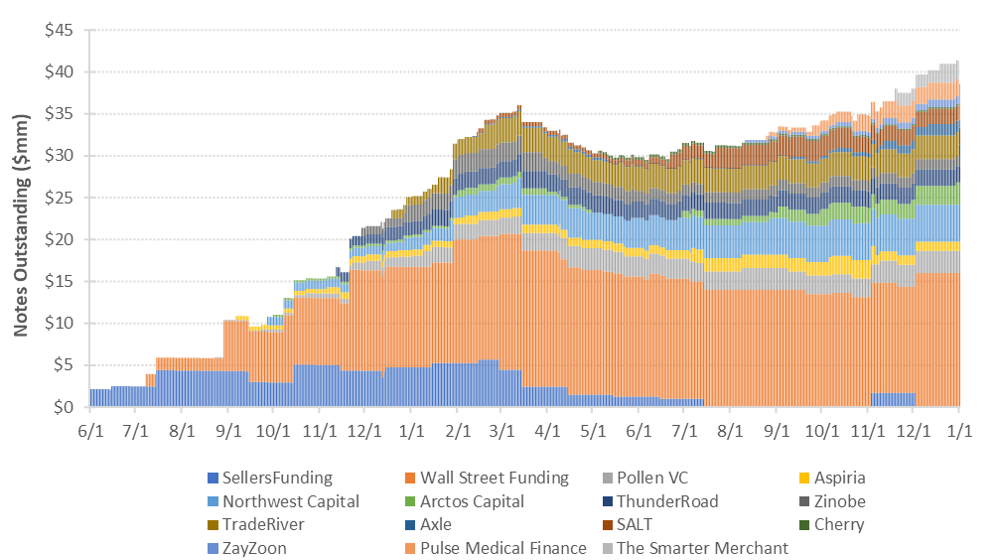

The STNP market (including retail and prime issuances) continued to expand during the month of December. As of January 1st, a total of $38.5 million of notes were outstanding following $26.0 million of issuance. The monthly issuance volume and the current volume outstanding at month end both set a record for the STNP Cadence platform.

- Our STNP issuance since inception stands at $224.8 million, compared to $198.8 million at the time of last month’s update. Issuance has spanned 164 individual structured note offerings from 15 borrowers.

- STNPs issued in December had a weighted average APY of ~17.1%, with average tenors hovering a little below the 543 days mark, heavily weighted by the $16 million prime transaction for Wall Street Funding. This compares to a new issue weighted average APY for November of ~11.7%.

- Cadence has officially returned over $4.2 million in aggregate interest payments since inception to our growing investor base.

- With ~$2.8 million in loss of principal related to 8-B, 8-C, 8-D and 8-E issuances, this represents a 1.26% default rate on issuance since inception.

December Capital Markets Activity

In the month of December, we continued to focus our attention on analyzing and monitoring underlying asset performance for all of our borrower partners. With the new surveillance reports available for Pollen, we are now publishing periodic surveillance reports for all active borrowers on the Cadence platform. You can find more information on how to best navigate these reports in our primer, Delivering on Transparency with our Latest Surveillance Reports.

In an effort to streamline the naming conventions of our offerings, Cadence will begin using a more market standard naming structure that is simultaneously more transparent, informative, and relevant for investors. These changes will affect deals with a close date of January 1st, 2021 and beyond, with each new deal conforming to this new naming structure. Though this is a minor change, we wanted to clearly outline the new structure as you will see this naming convention going forward. You can learn more about these and how to read them here.

During December, we successfully priced 8 offerings across our STNPs to land at $26.0 million, bringing our 2020 total to $181.3 million.

- We were able to meet or increase target transaction sizes in 7 out of the 8 transactions issued this month. Pending market conditions, we are planning to announce a partnership with two new borrower partners in January that will provide new opportunities for investment.

- Offerings ranged widely in terms of tenor and size, from a 3-month senior issuance of $925,000 with ZayZoon pricing at 11.25% to a $209,000 senior 9-month note with Cherry pricing at 9.75%.

- As we execute on our corporate strategy of graduating high quality borrowers into the institutional markets, we are proud to share we completed our first successful transition with one of our longstanding partners, Wall Street Funding.

- Cadence acted as sole placement agent on a $40 million senior secured credit facility via a newly formed SPV with a 26-month tenor and standard borrowing base structure.

- Cadence also acted as sole lender and agent on a $16 million senior secured term loan with a 26-month tenor, which was syndicated to roughly 60 investors via CadencePrime, our newly launched vertical offering bespoke deal flow.

Please see below our 1-month projected and 2-month historical issuance calendars, along with a few charts highlighting STNP market activity since inception for further insight.

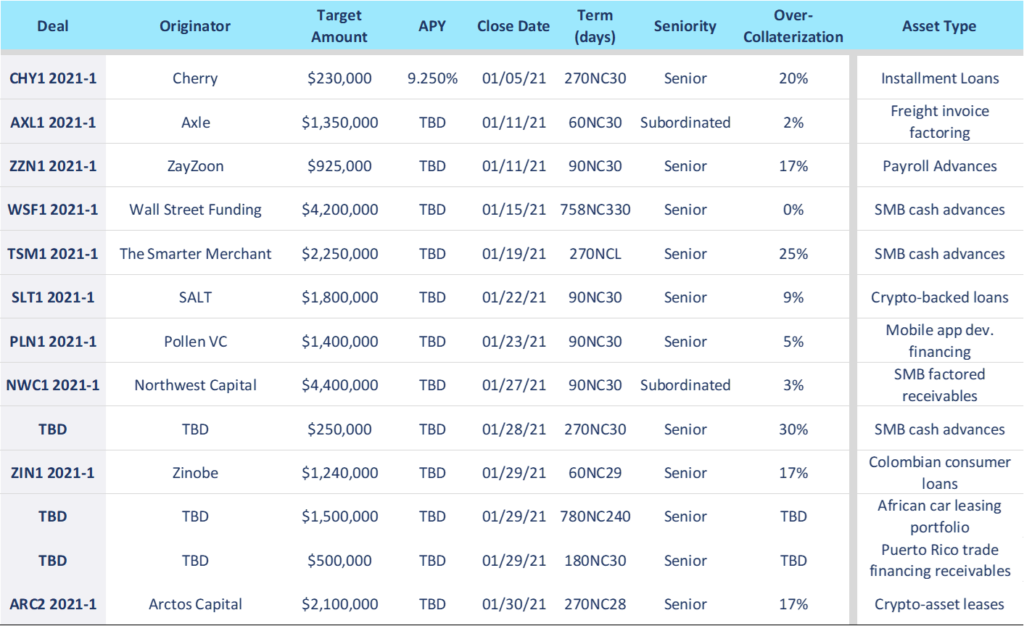

Projected Issuance

Note: Over-Collaterization expressed as a percentage of Cadence portfolio size (in prior monthly updates it was expressed as a percentage of the note size).

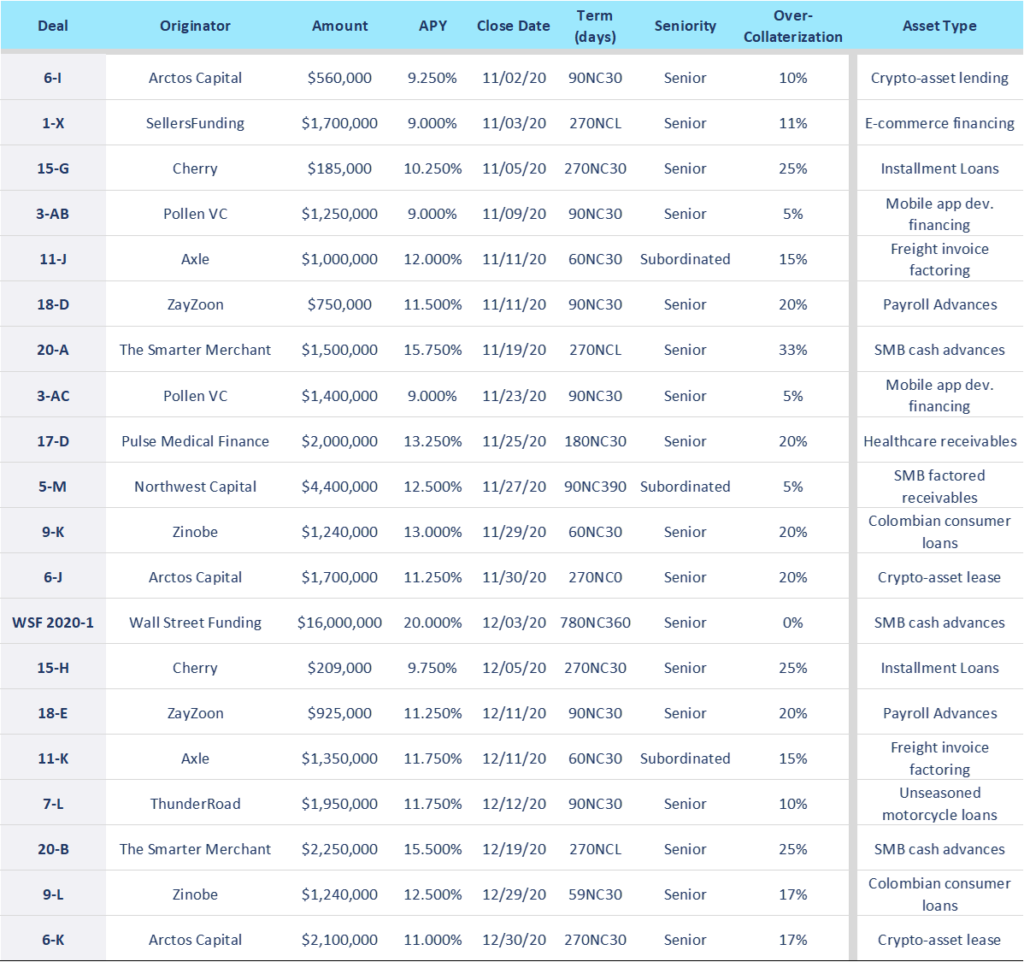

Historical Issuance

Note: Over-Collaterization expressed as a percentage of Cadence portfolio size (in prior monthly updates it was expressed as a percentage of the note size).

STNP Market Activity

Should you have any questions or would like to learn more about Cadence, our issuances or the STNP market, please do not hesitate to reach out to us.

Nothing in this post should be construed as an offer to sell securities or a solicitation of an offer to buy securities. All investment involves risk and the possibility of loss, including loss of principal, and neither past performance nor forward-looking information is a guarantee of future results. Any decision to invest must be based solely upon the information set forth in the offering documents, regardless of any information that may have been otherwise furnished, including in this update.

Please note that this article was originally published in January of 2021, when Percent was known as Cadence.