Each month, Percent’s Capital Markets team releases an update that takes a look back at the previous month’s dealflow and highlights the upcoming deal pipeline. Below is Percent’s Short Term Note Program (STNP) monthly market update for February 2021.

Market Commentary

The COVID-19 pandemic continues to challenge the United States and the broader world.

The U.S. experienced record cases, hospitalizations, and deaths this January. While daily new cases have fallen in recent days, prevalence of new strains continue to threaten the vaccination initiative and the gradual opening of the global economy.

Earlier in the month, President Joseph Biden was inaugurated following unprecedented riots in the Capitol. Following the inauguration, the Dow, S&P, and NASDAQ hit all-time records, with the NASDAQ experiencing levels that were more than double that seen in March of 2020. These highs, however, were short lived, as the S&P closed January down 1.1% for the month — the first negative performance month since October. The S&P has now also fallen below its 50-day moving average. Additionally, market volatility has increased substantially. The VIX index spiked 62% to 37.32 on 1/28/21 as “Reddit day traders” pushed $GME, $BB, and $AMC to anomalous levels.

The Federal Reserve met on 1/27/21 and reported they were keeping the fed funds rate anchored at near 0% to continue to spur economic growth in the aftermath of the COVID-19 outbreak. Following the Fed’s meeting on 1/28/21, the Commerce Department released Q4 GDP results indicating an increase by 4%, which was slightly below the Dow Jones’ 4.3% expectation. The U.S. economy saw a 3.5% decrease in GDP over the past year, marking the worst decline since the end of World War II.

On the fixed income side, treasury yields fluctuated after the GDP report, with the 10 year and 30 year benchmarks moving to 1.07% and 1.87%, respectively. The 10 year rate saw an increase of 155 basis points since December of last year.

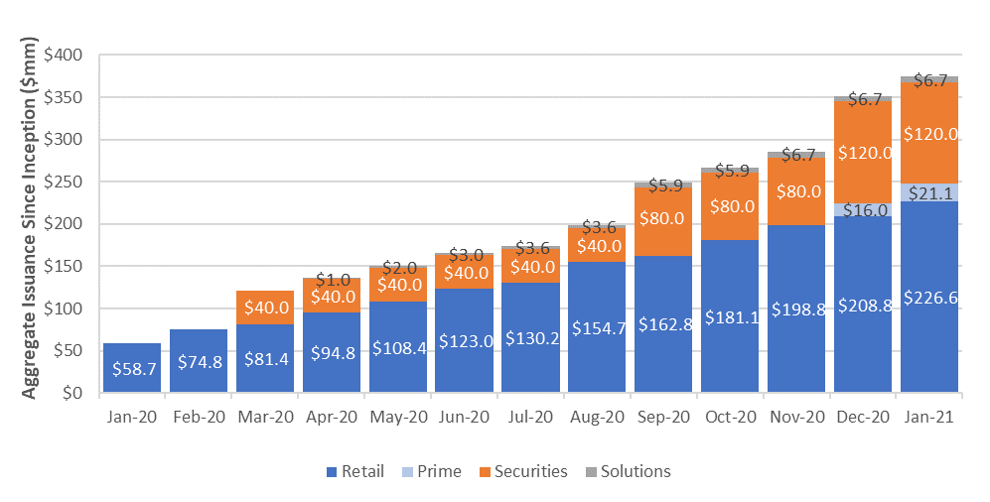

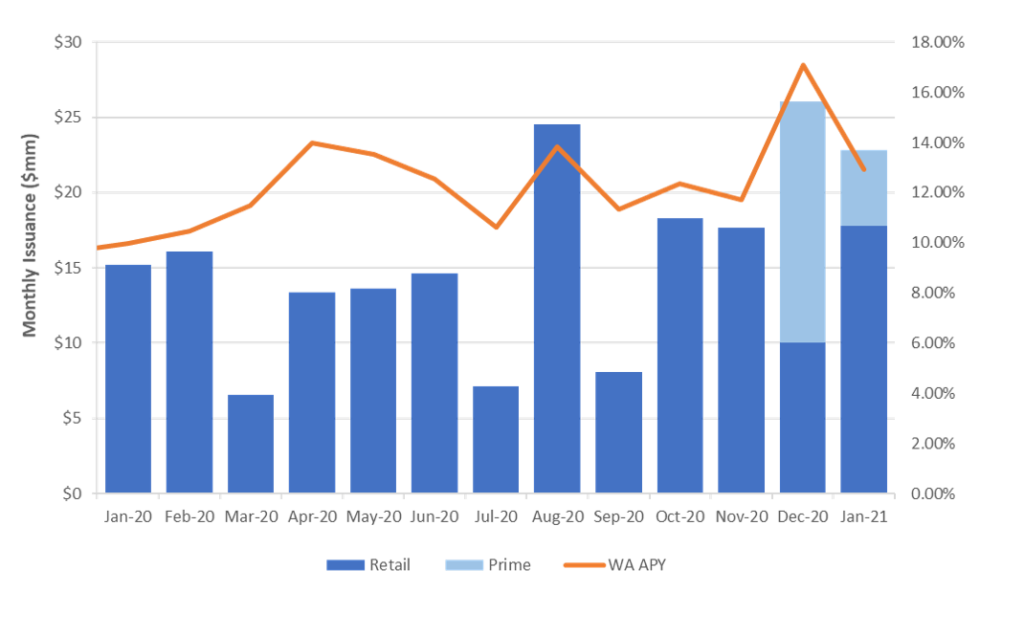

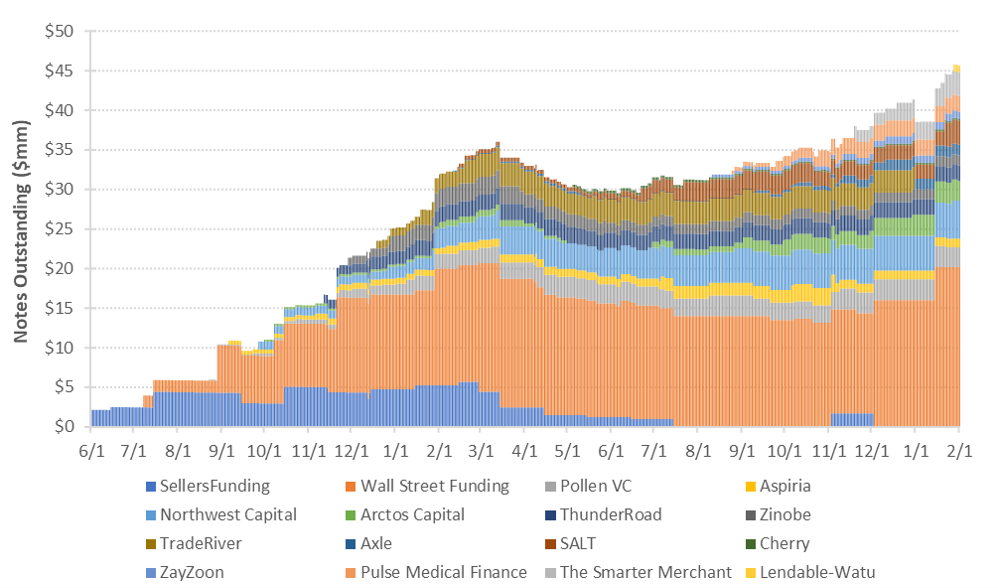

The STNP market (including both retail and prime issuances) continued to expand during the month of January. As of February 1st, a total of $45.6 million of notes were outstanding following $22.8 million of issuance. The volume outstanding during the last week of January set a new record high for the STNP Percent platform.

- Our STNP issuance since inception stands at $247.6 million, compared to $224.8 million at the time of last month’s update. Issuance has spanned 175 individual structured note offerings from 16 originators.

- STNPs issued in January had a weighted average APY of ~11.9% with average tenors hovering a little below the 270 days mark, heavily weighted by the $4.2 million Prime transaction for Wall Street Funding.

- Percent officially returned over $4.8 million in aggregate interest payments since inception to our growing investor base.

With ~$2.8 million in loss of principal related to 8-B, 8-C, 8-D and 8-E issuances, this represents a 1.14% default rate on issuance since inception.

January Capital Markets Activity

We announced two new strategic partnerships in the month of January.

First, we announced Edge Capital, an Idaho-based platform connecting small and medium-sized businesses across the U.S. with capital. Edge Capital leverages a data-driven and technology-enabled underwriting and funding model that analyzes SMB’s sales volumes and other metrics. Since inception, Edge Capital has extended $6 million in capital to hundreds of companies.

We also announced a new strategic partnership with Lendable, a leading structurer of private credit facilities. Established in 2015, Lendable was founded with the goal of providing debt financing to early and mid-stage fintechs operating in frontier markets, all while giving access to underserved groups in need of crucial financial services.

During January, we successfully priced 11 offerings across our STNPs to land at $22.8 million, with $17.8 million from our retail platform and $5.1 million related to our new prime vertical.

- We were able to meet or increase target transaction sizes in 10 out of the 11 transactions issued this month.

- Offerings ranged widely in terms of tenor and size, from a $1.35 million subordinate issuance with Axle Payments pricing at 11.25% to a $875,000 2-year note with Lendable for Watu pricing at 11.00%.

Please see below our 1-month projected and 2-month historical issuance calendars, along with a few charts highlighting STNP market activity since inception for further insight.

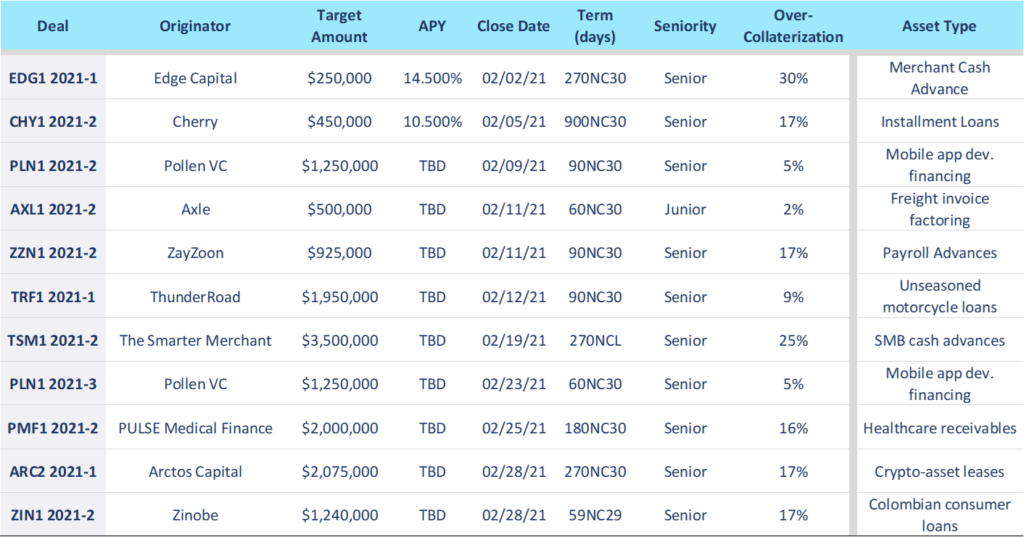

Projected Issuance

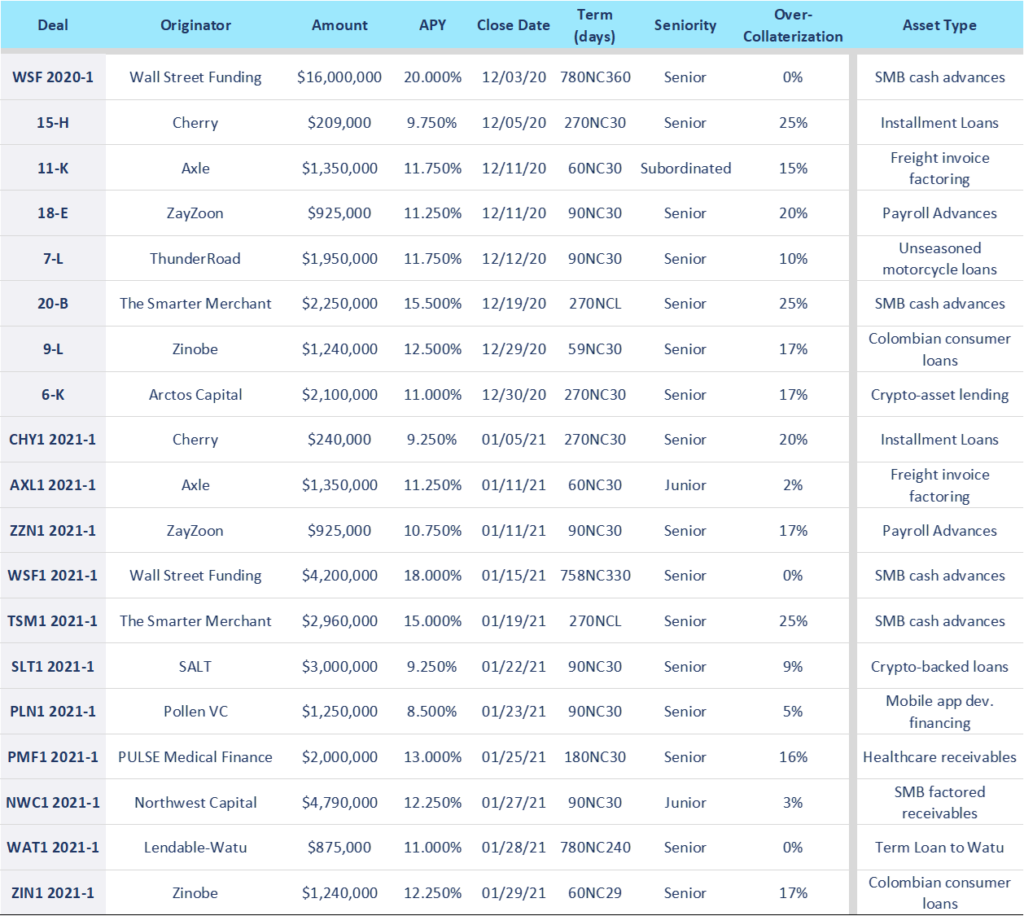

Historical Issuance

STNP Market Activity

Should you have any questions or would like to learn more about Percent, our issuances or the STNP market, please do not hesitate to reach out to us.

Nothing in this post should be construed as an offer to sell securities or a solicitation of an offer to buy securities. All investment involves risk and the possibility of loss, including loss of principal, and neither past performance nor forward-looking information is a guarantee of future results. Any decision to invest must be based solely upon the information set forth in the offering documents, regardless of any information that may have been otherwise furnished, including in this update.