Accredited Investors: Rules, Regulations, and How to Tell If You Are One

You may have heard the term “accredited investor” at some point. Maybe it came in the form of “Angel Investor” while watching the popular HBO series Silicon Valley. Maybe it’s from an ad for a wealth manager, or from one of your wealthy finance friends. Or perhaps, you read about it by perusing investment tip sites.

Regardless of where you may have heard the term, chances are you’re interested in better ways to invest your money.. So have you ever wondered where the term came from and why it’s gaining popularity now?

This story goes way back. Back to the start of the Great Depression.

Where Did the Term Accredited Investors Come From?

In the early 1920s, the US economy was booming. Investor confidence was high due to the newly established Federal Reserve designed to curb the booms and busts of the stock market. Investors became increasingly speculative and used debt to fuel their speculations in hopes of higher returns. Business ventures promised great returns without substantial evidence to back up their claims. Then in 1929, the stock market crashed causing the greatest economic depression the US capital markets had ever seen.

In an effort to prevent a future market crash, Congress passed the 1933 Securities Act which served two purposes. The first is to require investors access to financial and other significant information concerning the securities in which they invested in. The second is to prohibit misrepresentations, fraud, and deceit in security sales. The goal of this law was to protect the everyday investor.

Private offerings, however, were exempt from securities laws. Quickly, issues around what was considered a “public offering” arose and the Supreme Court had to move to decide which class of people needed to be protected under the Securities Act. The court ultimately determined that for an investor to be eligible to participate in a “private offering”, the investor had to have sophisticated financial knowledge to evaluate the investment and the financial capacity of suffering a total loss.

In an effort to further standardize investor eligibility to participate in private investments and to help small businesses raise capital, the Securities and Exchange Commission (SEC) adopted rule 501 of Regulation D. Rule 501 defined the term Accredited Investor from a monetary perspective and completely removed the “sophisticated investor” provision.

Definition of Accredited Investor According to the SEC

Before 2020, an accredited investor in the US was anyone who satisfied the following conditions:

A. Earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonable expectation of the same for the current year

OR

B. Has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence)

As of December 9, 2020, accredited investors can also be certain individuals who can demonstrate financial literacy, know-how, and history in the world of finance. This includes (and is limited to):

- Investors with certain professional certifications, designations, and/or credentials, including Series 7, Series 65, and Series 82 licenses while qualifying as "natural persons." (Investors with other licenses are to be considered and added in the future.)

- "Spousal equivalents," or spouses of accredited investors who pool their assets along with said investors to meet the previous net worth and/or income requirements for accredited investors. (Eg. If you are married to an accredited investor and share monetary resources, you are now also an accredited investor.)

- Those who are “knowledgeable employees” of a private fund.

- Limited Liability Companies (LLCs) and Family Office entities with $5 Million assets under management. SEC- and state-registered investment advisers (but not reporting advisors) of these entities can also now be considered accredited investors.

- Entities including Native American tribes, governmental bodies, funds, and entities "organized under the laws of foreign countries" with investments over $5 million — as long as they were not formed solely to invest in a specific accredited investment.

As an individual, there are three ways to prove you are an accredited investor.

1. Third Party Verification Method:

You can obtain a written confirmation from any of the following:

- A registered broker-dealer

- An investment adviser registered with the Securities and Exchange Commission (SEC)

- A licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law

- A certified public accountant who is duly registered and in good standing under the laws of the place of his or her residence or principal office

The written confirmation provided must certify that reasonable steps were taken to verify that you are an accredited investor within the prior three months.

2. Income Verification Method

You can provide government or official records that that show your income, such as tax filings or pay stubs. Otherwise, you can obtain a letter from your accountant or employer confirming your annual income. You will also need to make an affirmative statement that your expected income in the current year will meet the minimum income level.

3. Net Worth Verification:

You can disclose your assets and liabilities so that net worth may be calculated by providing a credit report, evidence of assets, and disclosure of liabilities.

What are the benefits of being an accredited investor?

If you’ve made it this far in the article and discover that you’re qualified, congratulations! Many people who qualify as accredited investors either are not aware of their status, and thus do not know how to take advantage of it.

To help you learn more about investing outside of the public markets, we’ve assembled just a few reasons why being an accredited investor yields more opportunities and access.

Higher Yield Opportunities

When a company raises money outside of the public capital markets, it is typically done as a private placement. Oftentimes, these private placements offer higher yields than what’s offered in the public markets. This is due to the underlying issuer’s access to attractive capital. As an accredited investor, you are able to participate in these offerings. With the advent of platforms like Percent, it is now easier than ever to gain access to these higher yielding opportunities.

Opportunity to Invest in Small Businesses

As an accredited investor, it is also possible to support small businesses with missions you care about. Platforms like AngelList allows you to connect with startups of all stages. At Percent, we source working capital finance deals to help food manufacturers, e-commerce companies, and other small businesses grow.

Diversify Your Portfolio

As interest rates rise, solely investing in the public markets will offer limited diversification options for your investment portfolio. Finding alternative assets to invest in that are largely uncorrelated with the public markets will help reduce systematic risk exposure . As an accredited investor, you have access to these opportunities that your non-accredited peers cannot even consider.

What Can Percent Do for Accredited Investors?

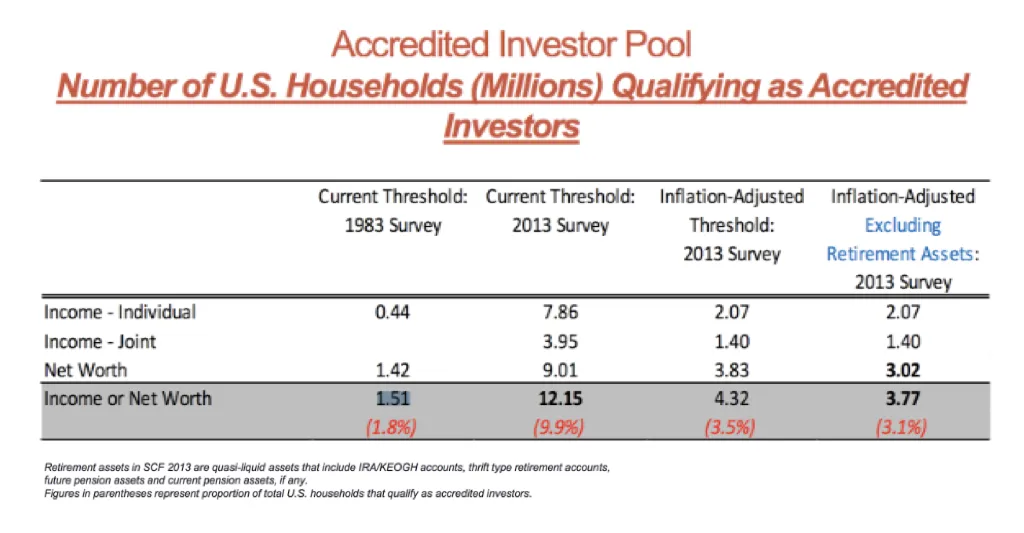

According to the last SEC accredited investor survey, The number of accredited investors in the US has increased from 1.15 million Americans in 1983 to 12.15 million Americans in 2013. Today, there are twelve times more accredited investor households than there was in 1983. The SEC has not adjusted the accredited investor income or net worth threshold for inflation. This means more and more people have access to private investing opportunities than ever before.

At Percent, our mission is to make alternative investments as accessible as possible. If you qualify as an accredited investor, and you have an interest in alternative investments, we’d love to show you just how valuable diversifying into alternative investments can be for your portfolio.

Update: This post was updated on December 9, 2020 to reflect the newest legal definition(s) of accredited investors.