Extra, Extra! Rates Are Moving Higher!

There’s been a lot of talk about “rates rising” over the last few years. Maybe you read in the news that the housing market is cooling down thanks to higher mortgage rates. Perhaps you’re getting pummeled with high yield savings account ads. Or possibly you’re out on the town with your Wall Street buddies one night and you can’t help but overhear them talking about the yield curve over a few cocktails!

Chances are, you’ve heard that change is around the corner. So why should you care, and what can you do to take advantage?

Breaking Down Modern Interest Rates

Let’s start with the fundamentals: interest rates drive everything. From the amount you pay on those stubborn student loans all the way to how likely Venezuela’s economy will collapse. It is all dependent on interest rates, specifically U.S. interest rates. So what are interest rates and why are they so important to the world economy?

There are two main entities involved in determining US interest rates: the US Treasury, and The US Federal Reserve (the Fed). The Treasury sets the “benchmark interest rate,” which is the Treasury’s cost of financing the government. The Fed influences the rise and fall of interest rates through its monetary policy.

What Does The US Treasury Do?

The U.S. Treasury’s mandate is to fund the operations of the U.S. Government. While we all pay annual taxes to Uncle Sam, the funds from taxes don’t fully cover government operations. Expenses include our military spending, federal entitlement programs, and salaries for government employees. Because of this shortfall, the Treasury has no choice but to borrow from investors around the world. It does this by issuing Treasury bills, notes, and bonds (a.k.a. debt). Investors could be Bank of America, you, Japan, CalSTRS, Harvard, me, literally anyone. The interest paid on these debt instruments serve as the world’s “benchmark” or “risk-free” rate because no-one believes the U.S. will ever skip a payment.

You might be asking, well, I’ve never bought any Treasuries so none of this is really relevant to me. Well, yes and no. You might be right that you’ve never actually had the geeky pleasure of holding a Treasury Bond certificate in your hand. However, Treasuries underpin the cost of many financial instruments. They impact car loans, mortgages, fixed-income securities, and even stocks.

What About The Fed?

While the U.S. Treasury is busy funding our country’s expenses, the U.S Federal Reserve has a very different role. The Fed’s dual-mandate is to maximize employment and keep prices stable by influencing the level and direction of interest rates. Without the Fed, the economy would go through prolonged periods of expansion (boom times) and contraction (gloom times). This is largely known as credit cycles. The Fed comes to our rescue by creating much shorter term credit cycles by encouraging banks to lend more or less via controlling short term interest rates.

Following the 2008 Financial Crisis, the Fed implemented a very expansionary monetary policy (low rates). After using all of the tools at its disposal to turn the economy back around, it’s now entering into a contractionary monetary policy (high rates). The rate it sets has massive implications for the economy, the U.S. Treasury (the biggest borrower) and literally everyone else. This is why the names Bernanke, Yellen and Powell are so familiar.

What Do Rising Interest Rates Affect?

Higher Cost of Bank Loans

Loans, are typically offered to you at some rate north of what the lender is able to secure elsewhere . The difference between what’s offered to you and their cost of that capital is called net interest margin. This is what banks do to make money. In fact, there’s an old banking joke called the 2-4-2 rule. Bankers borrow from someone at 2%, lend to someone at 4% and hit the golf course by 2pm! Commercial banks in the U.S. enjoy very cheap capital in the form of deposits. That savings account which is now yielding you 2% is the price banks have to pay in order to lend 9x your money to others at 4%.

Here’s the kicker: the only reason they are lending you 2% now is because they know you can just go buy a Treasury bond with the same yield , if not more. Banks aren’t doing you a favor or being generous, they are trying to be competitive against the risk-free rate and what their competitors are offering you (all those ads!).

Impacts to Company Valuations

When it comes to companies, interest rates have both direct and indirect effects on valuation.

Direct Effects: Stock Prices

A publicly traded company’s stock price should represent the present value of its expected future earnings and dividends. Present value means all of these cash flows are discounted at an applicable discount rate. The discount rate reflects all the risks associated with the company’s ability to generate these cash flows PLUS the risk-free rate. This ends up being a similar rate at which an investor should otherwise demand if they lent the company money today for a very long time but had no guarantee of being paid back, (aka the equity risk premium). Higher U.S. interest rates = lower present values = future dividends and profits worth less = stock devaluation.

Direct Effects: Fixed-Income Values

Companies issue loans and bonds, generally called fixed-income securities, directly to investors when they need to raise money without selling equity. While a company’s stock price may represent other intrinsic values not captured in the discounted cash flow method, fixed-income securities are much more explicitly tied to rates.

This is because fixed-income securities have a set payment schedule that reflects the risk free rate from the date it was issued. As rates rise over time, discount rates also rise causing the bond’s future payments to be worth less.

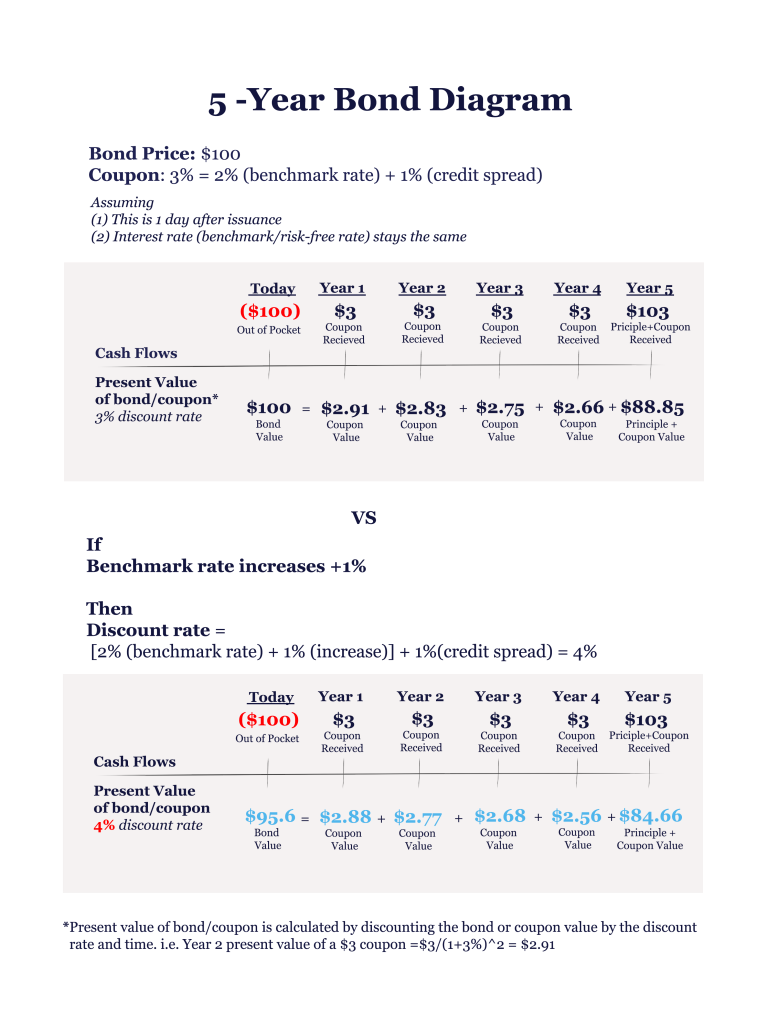

Here’s an example:

If a company issued a 5-year bond at 3% when the 10-year risk-free rate was 2% and their credit spread remains at 1% (2% + 1% = 3%), benchmark rates going up 1% would lead to a 4% discount rate on all those coupons and principal over 5-years. This would lead to a decline in the bond’s current price and investors who held the bond during this period would experience losses.

Higher U.S. interest rates = lower net present values = bond price declining

Indirect Effects

A company’s equity and bondholders could also be indirectly impacted by higher rates. If the company’s banks or investors passed along a higher risk free rate in their borrowing terms, then the added interest expense would ultimately reduce the company’s earnings. If they can’t pass this higher cost onto customers or offset it in other ways, the overall company’s value declines. Furthermore, demand for product bought on credit could also drop and dampen top line sales. This is because consumers can no longer afford the company’s products or do not want to pay a higher financing rate.

The ripple effect is real and it’s the reason why we should all care.

—

What You Can do to Really Diversify Your Portfolio

Don’t Put All Your Eggs in One Basket

While a well diversified portfolio of stocks and bonds is a tried and true strategy, higher interest rates will negatively impact everything in that portfolio. This means your “well diversified” portfolio actually doesn’t protect you in a rising or declining rate environment. This is because all of the underlying assets move in the same direction. The pervasive nature of interest rates in our financial economy makes it very difficult for the average investor to efficiently hedge their investment portfolio. The Fed’s actions in raising or lowering interest rates affect stocks, bonds, mutual funds, and ETFs alike.

So what if you want something else? Something that isn’t correlated to interest rates in the way that stocks, bonds, savings accounts, CDs, loans and virtually everything else available to us non-hedge fund managers? A rising tide shouldn’t only lift the yachts.

Enter Percent.

The Percent Alternative

Percent is revolutionizing the investment landscape by bringing largely uncorrelated opportunities to your doorstep. We’re providing retail and institutional investors reliable access to standardized investments that have traditionally only been available to savvy investors. These assets have cash flows and intrinsic values that are not based on any underlying risk-free rate and have nothing to do with discounted cash flow analysis. Our thoughtfully structured securities grant investors unique exposure. They may be a suitable addition to any well-diversified portfolio.

Percent can provide you with the benefits of largely uncorrelated alpha and put you in the right vessel to rise high with the tide.