A Female Approach to Alternative Investing

Mother knows best. This age-old wisdom not only applies to navigating through life’s ups and downs, but it might also apply to investing.

Today, 40% of women are their family’s breadwinner. According to STEMConnector’s 2016 study, Women’s Quick Facts: Compelling Data on Why Women Matter, 90% of women will eventually take charge of their family’s wealth. This means there could be more female investors than ever before, which is amazing since society’s gender norms has always considered the role of financial management to be a “male” task.

In the Wells Fargo/Gallup Investors and Retirement Optimism Index from August 2016, where 1,021 investors with savings and investments worth $10,000 or more were randomly selected from across the country, more men than women reported they have a high level of investing experience. As a result, men reported higher confidence in their investing ability than women. Surprisingly, however, women statistically performed better than men, both as individual investors, and as fund managers.

According to Financial Times, the HFRX Women index, which pulls together the performance of female hedge fund managers, has returned 9.95 per cent for the first seven months of 2017. This compares with 4.81 percent for the HFRI Fund Weighted Composite index, a broader gauge of hedge funds across all strategies and genders. So what’s the secret behind female investors outperforming and generating such positive returns?

Characteristics Driving Female Investors

Risk-appetite

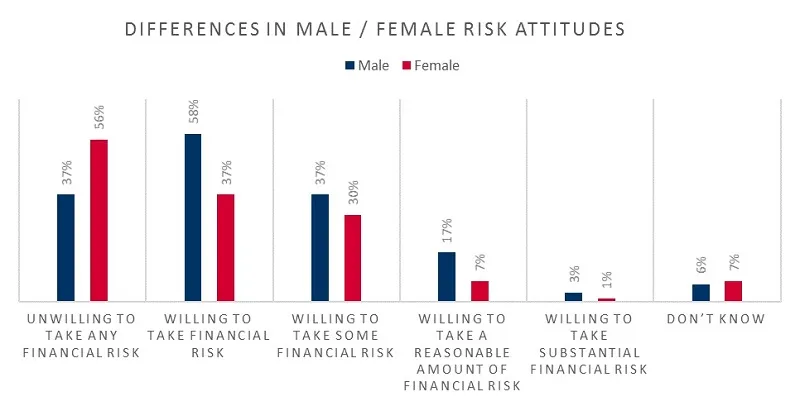

While the ladies can benefit from having more confidence when it comes to investing, male investors might be “too” confident. Overconfidence can lead to overtrading, which may result in high transaction fees and dampen returns. A report from SigFig found that portfolio turnover was 45% higher among male investors than female investors. The confidence disparity could also be the reason why women tend to be more risk-averse than men. A Willis Owen study showed 58% of male participants were willing to take financial risk versus only 37% of women. It appears that the female approach of double-checking numbers, taking extra steps to mitigate risk can help, and being less confident can help increase your returns.

Discipline

Women tend to focus more on long-term financial goals (e.g. saving for a summer home) than short-term performance. Thus, female investors tend to have greater conviction with their investment decisions. They conduct thorough research before deploying capital, and stay more resilient than men through market volatility. Another Wells Fargo study, which tracked trades from 2010 to 2015, found men are 6X more likely to make massive allocation shifts than their female counterparts. This impulse often leads to investors falling victim to market cycles.

Humility

Perhaps the biggest factor in the investment success gap between women and men is that women are more willing to learn. According to BlackRock, women are much more open to constructive advice than men. The 2016 Wells Fargo report mentioned previously also found that women are twice as likely as men to seek help and advice from financial experts, whereas men invested more independently and impulsively. A HSBC research shows that 17% of female participants spent more than a month researching investment options and consulting experts, as opposed to 13% of male participants.

Where Are The Women In Alternative Investments?

Individual Investors

Although empirical data may present women to be savvy investors, in reality women are only outperforming men in their investments…WHEN they invest. Across traditional investments in asset classes such as equities, participation by gender is more or less equal between men and women. However, despite rising popularity in the past few years, the investor base for alternative investments, such as private debt and real estate, is overwhelmingly male.

The primary reason why women do not invest as much as men in alternative assets is because of access. Unlike the traditional market, where transactions are predominantly automated and executed over public exchanges, alternative investing is very relationship-based. It’s an old-school who-knows-who way of doing business - sourcing investment opportunities by word-of-mouth. As a result, women are often left out of the boy’s club.

Women also invest lower amounts. Despite having more control over their own finances, women overall invest 40% less money in absolute terms than men according to a recent survey by Wealthsimple. Access to alternative investment opportunities have historically commanded high minimums, thus precluding many women from even considering this asset class as a viable option.

We’ve all heard of the saying “do more with less”, and this especially applies to women. Women earn about 78 cents on the dollar compared to men in the United States. This gender wage gap means women have less money to save. On top of having to contribute a higher percentage of their wages in order to reach the same financial objectives as men, women live on average 5 years longer. Thus, even when given the chance to invest, women may not want to to take risks and seize the opportunity. Lexington Law recently surveyed people on what they would do with an extra $1,000, men were 35% more likely than women to say they would invest the money.

Fund Managers

Although female fund managers consistently earn higher returns than their male counterparts, the statistic comes with a handicap. According to a study by Morningstar, women in alternative investing tend to be much more qualified and accredited than their male counterparts in a fund-management role, reflecting a hiring bias. In Preqin’s survey of 200,000 people at alternative investment firms worldwide, only 19% of employees were women, most of them junior. Women only represented 11% of all senior positions, and even less so in board member roles.

What is most interesting is that female fund managers have a very hard time raising capital. In KPMG’s 2016 Women Alternative Investment Report, an overwhelming majority of participants, both male and female, believe it’s harder for women to attract capital. The juxtaposition of the lack of women in alternative investing and their superior portfolio performance is indicative of a massive opportunity. That is, putting more women in positions of power in the alternative investment industry is not only good for women, but also for investors, and ultimately, the bottom line.

The Time Is Now

Times are changing, and women can change their financial narrative along with it. At Percent, we strive to empower all investors to reach financial comfort. We have created an inclusive online marketplace that any qualified investor can access, without necessitating a broker or financial advisor. With our low minimum investment requirements, investors can participate for as little as $500 per investment opportunity. This allows people who do not have as much money to invest, such as women affected by the wage gap, to enter the world of alternative investing.

Lastly, many of Percent's investment opportunities that are originated by our financing partners help female entrepreneurs scale and grow their business. These investments provide more women with the opportunity to generate wealth, while enable our investors to contribute to their financial success. So whether you are a female investor looking to take charge over your financial future, or an ally investor putting your faith in female-led businesses, the female approach to investing looks to be a win-win.