This article is the first part of a series on alternative investments.

While stocks and bonds come most readily to mind, there are many more types of investments available to individuals and institutions. These ‘alternative’ investments (so-called because they are not traditional equities or fixed-income securities) are numerous and have existed for decades.

As investors seek for ways to diversify holdings, find income, and grow wealth, their interest in alternative investments has grown steadily. In this article, we look at three different categories of investments: traditional, alternative, and hybrid (or non-traditional).

Traditional Investments, Defined

Traditional investments include publicly-traded stocks and fixed-income securities (government and corporate bonds). These assets are regularly traded and sufficiently liquid, enabling an investor to quickly and easily find a market-clearing price to enter or exit the investment.

The liquidity of traditional asset markets is reflected by very narrow bid-ask spreads and low (or, in some cases, no) commissions. In addition to being easily bought and sold, traditional assets like stocks and bonds have a long price history that is generally available, reliable, and trusted. In addition, diversified portfolios consisting of publicly-traded stocks and fixed-income securities, often mimicking various indices, are readily available in the form of mutual funds and exchange-traded funds (ETFs).

Alternative Investments, Defined

Alternative investments are infrequently traded and are not found on public markets such as an exchange. As a result, they are often illiquid, not easily valued, and difficult to price. Alternative investments cover a broad range of assets, from private credit or equity funds to bespoke private investments, and even unique objects or so-called ‘passion’ assets.

However, investor interest is starting to drive change in alternatives:

- Private credit and private equity funds increasingly have historical data performance available, particularly for funds managed by some of the larger and better-known private equity companies.

- Bespoke private investments in the equity and credit of smaller growth companies are becoming increasingly popular as investors seek value. In some cases, the ability to compare basic investment parameters is emerging.

- ‘Passion’ assets can include art, stamps, sports memorabilia, vintage cars, and fine wine – and even items that are one-of-a-kind such as original artwork. Some artwork, music, and similar bespoke assets have recently started to be digitized and sold via the blockchain in the form of non-fungible tokens (NTFs).

Select cryptocurrencies and NFTs can be characterized as alternative assets, noting that these assets do not have a recognized basis for consistently determining a price. A few of the most recognized cryptocurrencies like Bitcoin and Ethereum do offer liquidity, although price swings are unpredictable and at times extreme. Given wide variation in price transparency and liquidity in this evolving asset class, the case for characterizing cryptocurrencies and NFTs as alternative assets can be made for now – but is subject to change in the future.

Hybrid (Non-Traditional) Investments, Defined

A third category of assets shares attributes of both traditional and alternative asset classes. Hybrid, or non-traditional, investments include assets like real estate, precious metals, and commodities. While often grouped under the alternative investment umbrella, they have some significant differences.

Take real estate. One could argue that every piece of land, house, or office building is unique and will be priced for its specific attributes such as size and location. Although this would meet some of the parameters of an alternative asset, there is nonetheless a general market for real estate in a particular city or region, along with well-defined and readily available price/square foot data for each property type. Similarly, precious metals and most other commodities might have some quality or purity differences but, generally, can be easily traded at prices which are visible on various exchanges or markets.

Comparing Asset Attributes

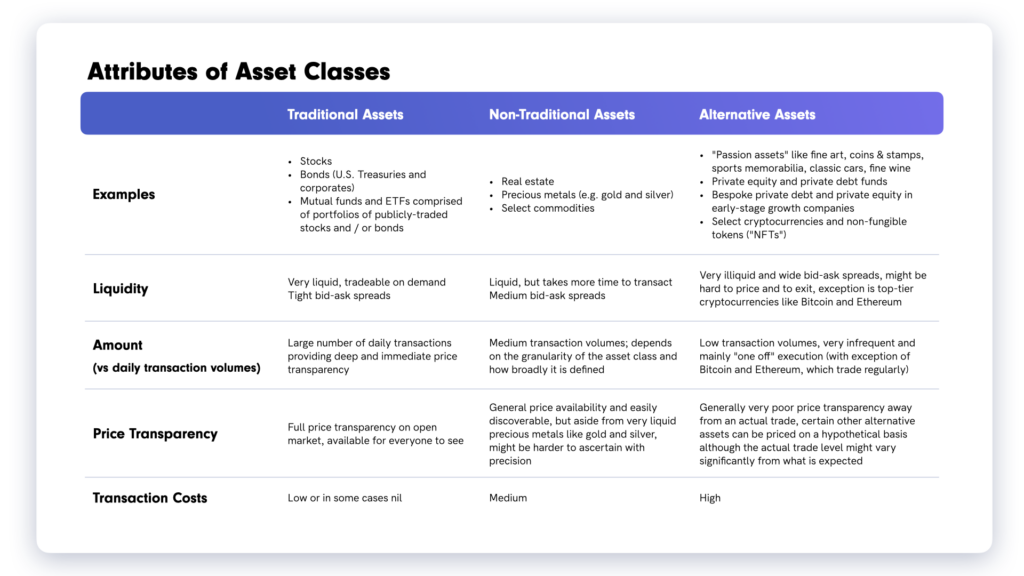

When moving from traditional to hybrid/non-traditional to alternative asset classes, there are noticeable differences in price transparency, bid-ask spreads, commissions, and liquidity as summarized in the table below.

Broadening Access to Alternative Investments

The Percent platform was designed to give accredited investors exclusive access to private credit investments. Private credit is an asset class of privately negotiated loans and debt financing from non-bank lenders. By definition, these are alternative investments.

Investing in this asset class gives investors exposure to small business and consumer loans, venture debt, and other forms of private credit. Attractive given their higher yields and largely uncorrelated performance vis-à-vis the public markets, these investments have historically been difficult for individual accredited investors to access.

Percent’s mission is to make private credit markets more transparent and accessible, benefiting all market participants. Percent provides investors with clear deal terms upfront, visibility into the underlying financials of the borrowers, and the ability to compare different types of transactions before investing. The duration and yield of Percent’s structured, securitized deals are established from the start so investors know what to expect in terms of returns and when. While the deals aren’t traded on a secondary market, the duration of a Percent note averages 9 months with refinancing or calls in as little as one month. This allows investors to redeploy their capital frequently to stay flexible in dynamic markets and achieve their investment objectives.

Part two of this series explores asset correlation in greater detail. Read Alternative Investments and Asset Correlation.