Q2 2024 Performance: Record-Breaking Growth Amid Market Evolution

Strong momentum continues as Percent breaks records, expands partnerships, and delivers solid investor returns in a dynamic market.

--

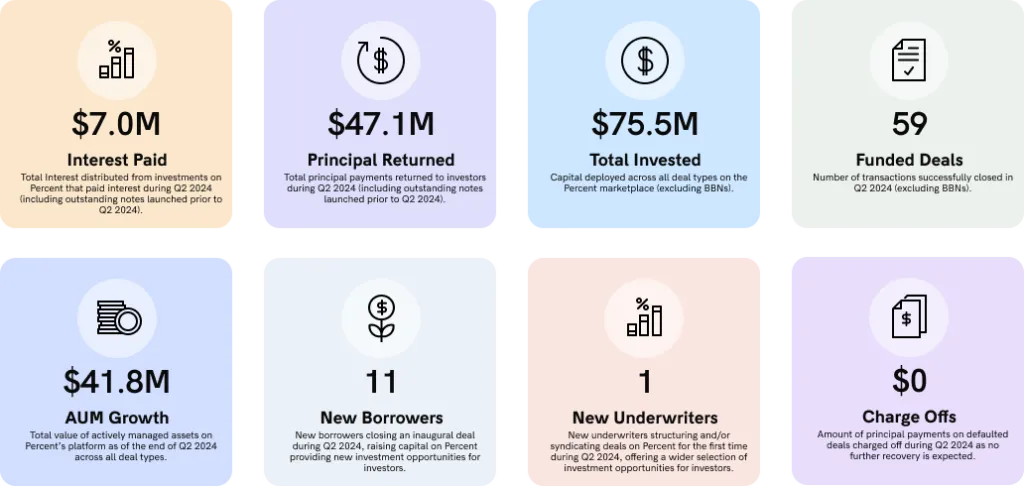

In 2023, Percent ended 2023 and began 2024 with record momentum. Building on this success, we are pleased to report that after a strong Q1 and Q2 performance, we continue to solidify our position in the private credit space and had a record-breaking first half of the year. This quarter continued to see the addition of new underwriters, borrowers, and investors, underscoring our marketplace’s ongoing growth and increasing sophistication, closing June 2024 with an AUM of $215.5 million, our highest level ever, representing a 24.1% quarterly growth and a 106.4% growth from June 2023.

Percent’s record-breaking growth directly translates into advantages for our valued investors:

- Diversified Portfolio: Our expanding marketplace grants you access to an even wider array of high-quality investment options, spanning various asset classes and risk profiles. This enables you to strategically diversify your portfolio and potentially enhance returns.

- Trusted Partnerships: Our reputation attracts top-tier underwriters who bring their expertise and exclusive deals to Percent. This ensures that you have access to the most promising investment opportunities in the market.

- Enhanced Deal Flow: With an increasing number of deals, you have more choices than ever to find investments that perfectly align with your financial objectives and risk tolerance.

Expanding Our Ecosystem: New Borrowers Fuel Diversification

Our commitment to providing diverse investment opportunities is reflected in our growing borrower base. In Q2, we welcomed 11 new borrowers from a variety of industries and geographies, further diversifying our marketplace offerings:

- Flow48 ($2.4M issued across 3 deals): Dubai-based fintech offering working capital financing to SMEs in the UAE.

- Steadypay ($1.1M issued across 1 deal): UK fintech providing working capital to freelancers and SMEs since 2017.

- Garvy International ($0.2M across 1 deal): U.S. subsidiary of a Hong Kong-based global commodity trading company.

- Coast Funding ($0.5M across 1 deal): California-based provider of SMB financing across the U.S.

- Nexi ($2.4M across 1 deal): Florida-based provider of merchant cash advances and SMB financing.

- Royal En Em ($0.1M across 1 deal): U.S. subsidiary of a UAE-based global commodity trading company.

- FIT SRL ($1.8M across 1 deal): Italian luxury electric and manual bicycle wholesale manufacturer.

- Fresh Funding – Jr. Note ($0.6M across 1 deal): New York-based SMB financing provider, offering exposure to a portfolio of merchant cash advances.

- Noypitz ($0.3M across 1 deal): Holding company for intellectual property assets of Filipino restaurants.

- Fundo ($0.5M across 1 deal): Florida-based provider of merchant cash advances to the American gig economy.

- Landing ($0.5M across 1 deal): Los Angeles-based B2B beauty retail platform established in 2016.

This diverse range of borrowers spans multiple asset classes, geographies, and deal structures, providing Percent investors with an ever-expanding array of investment opportunities.

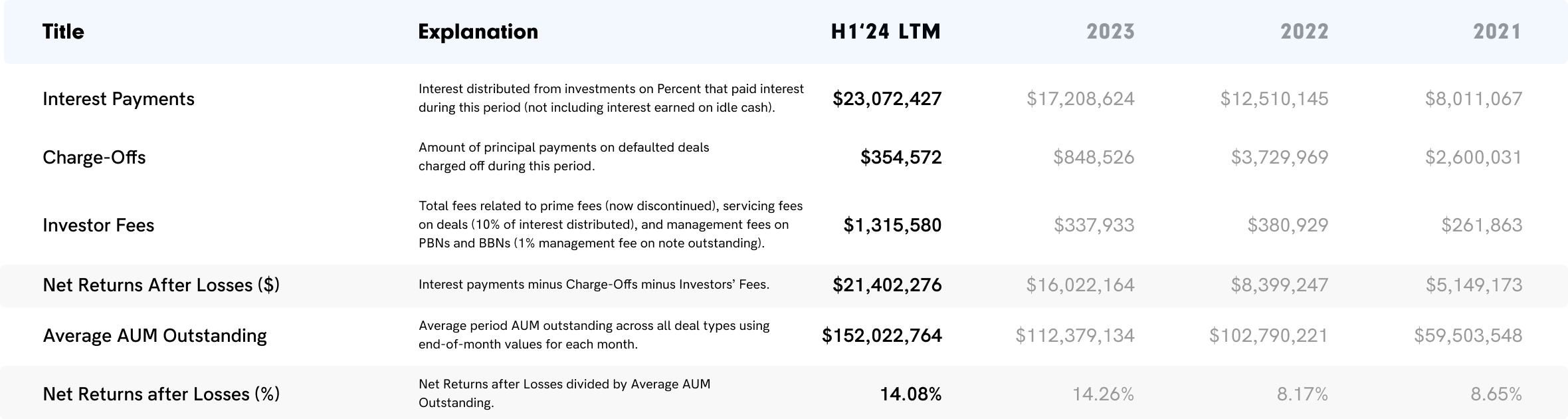

Investor Marketplace Performance: Returns Driven by Resilience

Over the last 12 months (H1 2024 LTM), investors earned $23.1 million in interest, with an average return of 14.1% after losses and fees. This performance, up from $19.9 million in Q1 2024 LTM, underscores Percent's continued ability to deliver attractive returns in a growing marketplace amid shifting market conditions.

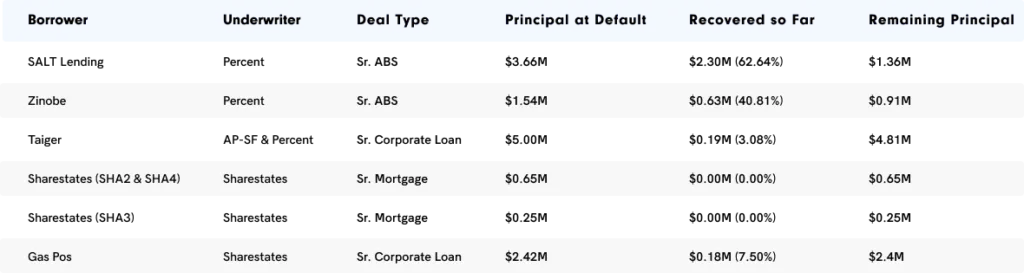

Transparency: Current Workouts

Transparency remains a cornerstone of our values. While workouts are a natural part of the private credit landscape, we are proactive in managing these situations and maximizing recoveries for our investors. Currently, six borrowers have deals in workout status, and we are actively pursuing robust recovery plans for each.

We provide detailed reports and updates on our Current Workouts and Historical Deals Charged-Off and Recoveries pages, ensuring that you have full visibility into our recovery efforts and the performance of our underwriting partners.

Navigating 2024 and Beyond: A "Higher-for-Longer" World and Unprecedented Global Elections

The global economic landscape remains complex, with the "higher-for-longer" interest rate environment presenting both challenges and opportunities. 2024 is also unique, being the largest global election cycle in history. As traditional lending channels tighten and public markets face volatility, the demand for flexible, customized financing solutions that Percent offers is only expected to grow.

This convergence of factors positions Percent for continued success. We are uniquely equipped to navigate this evolving landscape, leveraging our expertise, technology, and strategic partnerships to deliver exceptional value to our investors.

Here’s our proactive approach to:

- Expanding Asset-Based Borrowers: We’re focusing on high-quality asset-based loans, which have historically demonstrated resilience during economic fluctuations.

- Strategic Partnerships: We're forging strong relationships with underwriters who offer diverse expertise and unique deal structures, ensuring a broad range of investment options.

- Investing in Innovation: Our ongoing commitment to technological innovation ensures a user-friendly platform that empowers you to make informed investment choices.

By focusing on these key areas, Percent is confident in our ability to navigate market challenges and leverage opportunities to remain a leader in the private credit space. For you, our investors, this means continued access to attractive, diversified investment opportunities, even in a volatile market environment.

Percent In the Spotlight

Our innovative approach and market leadership continue to garner attention:

- Nasdaq featured Nelson Chu, our CEO, discussing the impact of recent interest rate hikes on regional banks, highlighting the "liability and duration mismatch" in their loan portfolios.

- The Financial Revolutionist showcased Percent's innovative use of technology and data-driven approaches to provide detailed transparency and financing solutions in the evolving private credit landscape.

- Alternatives Watch published an article by Chu discussing the booming private credit market. He emphasized Percent's role in democratizing access to this asset class and maintaining high investment quality through technological advancements.

- Forbes featured Nelson Chu’s insights on the phases of building a company, from bootstrapping to scaling and strategic vision, offering a firsthand account of his entrepreneurial journey with Percent.

- LSEG covered Nelson Chu’s defense of private credit’s structural protections and risk mitigation amidst concerns raised by JP Morgan’s Jamie Dimon, positioning Percent as a responsible and transparent platform for retail investors.

As we look to the future, our growing network of partners, expanding investor base, and unwavering commitment to transparency and innovation position us to make an even greater impact in the world of private credit. The opportunities ahead are more exciting than ever, and we're thrilled to continue this journey with our investors, borrowers, and underwriters. Stay tuned for more groundbreaking developments as we reshape the private credit landscape together.