How to Measure the Success of Your Investments

When analyzing the return of an investment, investors most often use two key metrics: The Internal Rate of Return (IRR) and Return on Investment (ROI), the latter of which is also known as the Holding Period Return. The goal for this blog post is to not only define these metrics but to demonstrate how they are used in real life by analysts and investors.

ROI and IRR are complementary metrics where the main difference between the two is the time value of money. ROI gives you the total return of an investment but doesn’t take into consideration the time value of money. IRR does take into consideration the time value of money and gives you the annual growth rate.

The concept of the time value of money is that a dollar today is worth more than a dollar any time in the future due to the fact that you can earn interest (which compounds) on your invested dollar.

Definitions

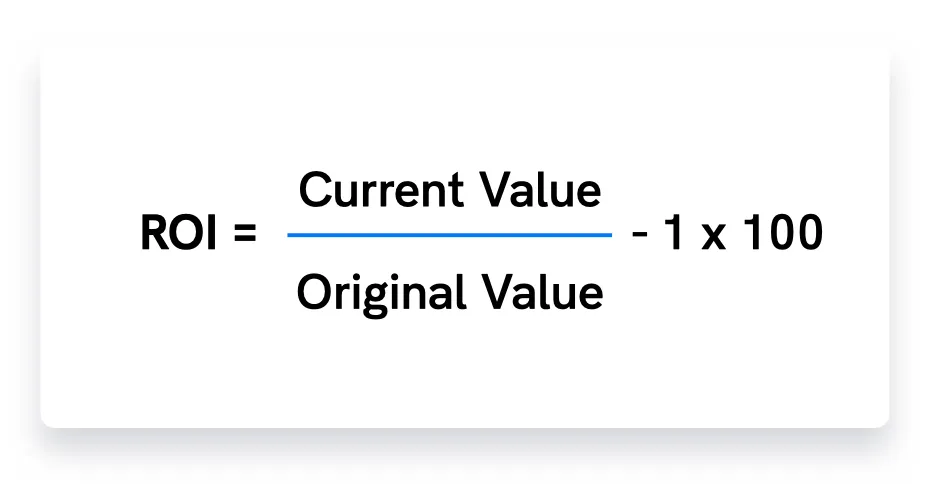

ROI is the percent difference between the current value of an investment and the original value.

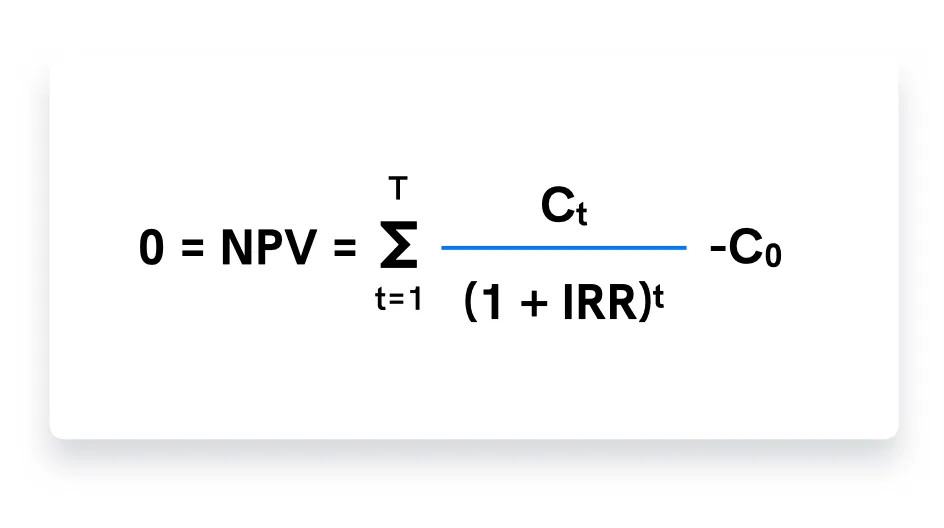

IRR is the rate of return that equates the present value of an investment’s expected gains with the present value of its costs. It’s the discount rate for which the net present value of an investment is zero. In other words, it is the ROI discounted for future cash flows.

NPV = net present value

T = number of time periods

Ct = total net cash flow during period t

C0 = total initial investment costs

*This formula is best solved by using a financial calculator or Excel

What Does This Mean In Layman’s Terms?

IRR is often used when measuring investments with various cash inflows and outflows over a period of time greater than a year. The IRR is an important measure of return because as time goes on the IRR of an investment decreases comparatively to the ROI which remains constant. The ROI will always be the same over the life of an investment because it is the total return from start to finish (irrespective of the investment period). The IRR, on the other hand, measures the annual growth of an investment, fully taking into consideration the time value of money. It is especially useful when evaluating alternative investments (such as private equity, real estate, hedge funds) that generate uncertain cash flows throughout the course of the investment.

For example, let’s say you are comparing two identical investment profiles with the same ROI but Investment A has a higher IRR than Investment B. What does this mean? It means that Investment A returned a higher annual growth rate in a shorter amount of time- even though the cash proceeds by the end of the investments are identical.

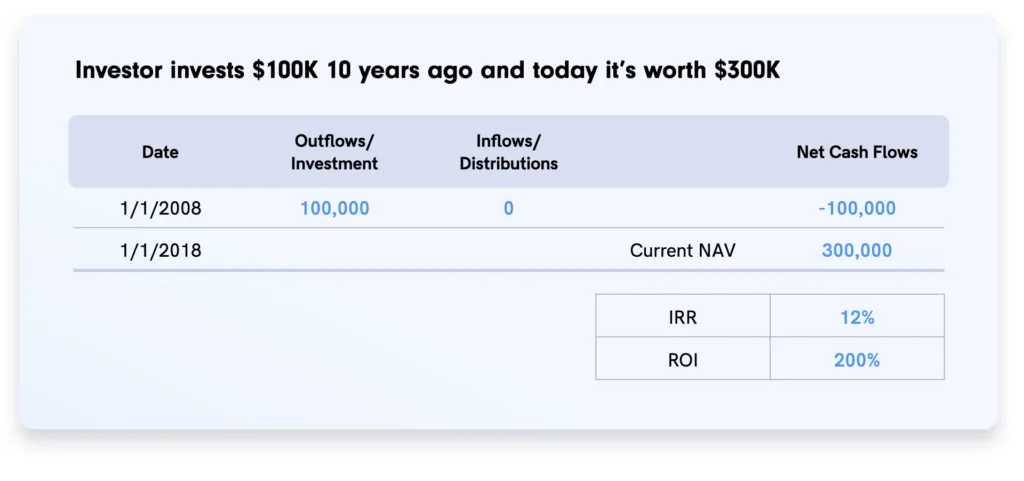

Figure 1.

To solve in Excel:

Figure 2.

IRR Calculation in Excel = XIRR(E3:E4,A3:A4) = 12%

ROI Calculation = (300,000/100,000-1) x100 = 200%

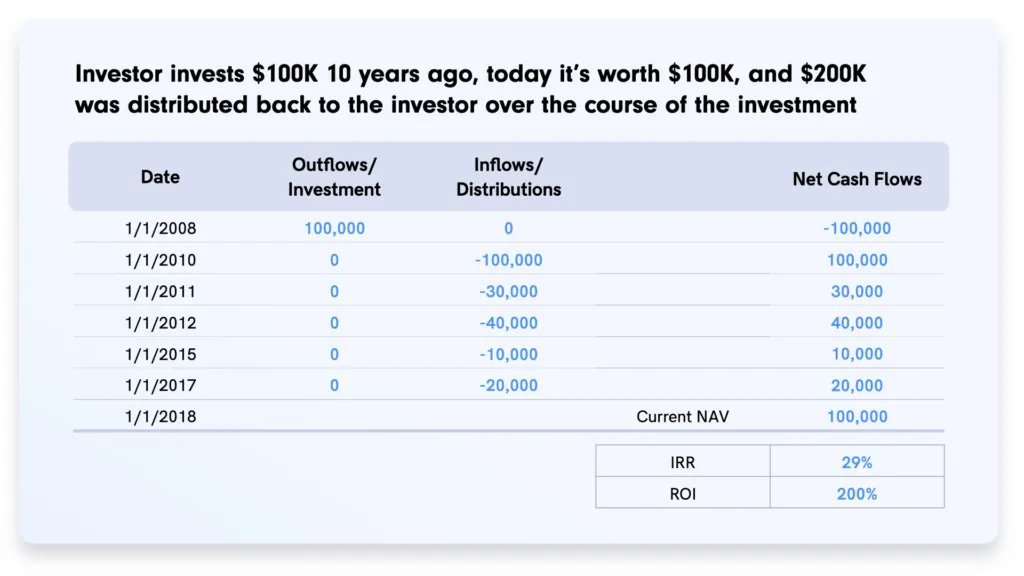

Figure 3.

IRR Calculation in Excel = XIRR(E3:E9,A3:A9) = 29%

ROI Calculation = (300,000/100,000-1) x100 = 200%

Why Does This Matter In The Real World?

IRR is different from ROI because ROI assumes all cash flows are received at the end of the investment, whereas IRR accounts for cash flows being received at different times over the course of your investment. The difference between the IRR calculation in Figure 2. vs. Figure 3. demonstrates this as the $100,000 returned after year 1 carries more weight (since it is discounted less) than the other remaining intermittent cash flows over the course of the investment where an aggregate $200,000 was returned. Therefore, the IRR in Figure 3 is higher (29% vs 12%).

A real life example would be a real estate project that is returning income or a private equity fund that is making distributions as it cashes in proceeds. The ROI remains the same as the overall investment return (cash over cash) is $300,000 or 200%. The distinction matters most when you are making investments and want to have an idea of your opportunity cost (of making another investment) and cash flows. To give you an idea of the powerful effect of the time value of money let’s look at Figure 3. If the investor had received the $100,000 distribution in 2015 instead of 2010, the IRR would decrease to 18% vs. 29%! Receiving a large cash distribution sooner rather than later leads to an increased IRR.

Where Does Percent Come Into Play?

IRR is an important measure for evaluating many types of alternative investments. It gives you insight into the annual growth rate of an investment over varying periods of time, particularly for investments with uncertain or uneven cash distributions.

IRR and ROI are metrics used to compare returns across different asset classes. ROI is typically used for short term investments (stocks) and assets with even cash flows whereas IRR is used for investments with uneven cash flows (most alternative assets). Alternative assets are typically compared against the performance of the stock market (best represented by the S&P 500 Index) because the latter represents an investor’s opportunity cost.

When analysts are evaluating whether or not to make an investment, the IRR gives them crucial insight into the value of the investment over time. It allows them to compare those returns against the performance of the traditional stock and bond markets. Here at Percent, we are offering access to unique asset classes that may offer attractive yields in conjunction with uneven cash flows over a multi-year time horizon. We encourage investors on our platform to use both ROI and IRR to help assemble a comprehensive return profile and assess how their investments stack up against traditional assets.

Read more about how Percent calculates returns on your Portfolio page.