STNPs in the Era of Coronavirus: A Report

The COVID-19 health crisis has had profound effects in private credit markets, both on investment performance and the very working of this corner of the financial sector. Through the last few months, Percent has continued to navigate the challenging yet opportunity-laden times according to its longstanding values of transparency and sound investment structures. However, there is no doubt that the economic and financial conditions brought on by COVID-19 have changed our investment platform, thankfully for the better. Though we can’t control the economic impact of coronavirus, or its idiosyncratic impacts on particular businesses or consumers, we believe there is always much we can do to protect investors.

The COVID-19 Threat

It's worth recalling the nature of the threat posed by the health crisis and economic downturn to private credit markets. The obvious impacts are the contraction in small business revenues brought on by stay-at-home orders and restrictions on public gatherings. As unemployment has risen, knock-on effects for consumers became increasingly concerning. Then there was the threat of operational disruptions at asset originators that might impact their ability to service assets, for example.

However, there are also the “unknown unknowns”. Less obvious impacts that nonetheless pose a potentially grave threat. For example, how would pre-COVID origination practices hold up from a risk-management standpoint after the pandemic? What new questions must originators ask of borrowers? What new questions should Percent be asking originators? How would seemingly less-discretionary or more ‘essential’ industries hold-up? Would geographies without stay-at-home orders actually perform better economically. Surely the cross-sectional impact of this downturn was going to differ from all previous recessions and market disruptions.

Informing Investors

In the face of such unprecedented circumstances, providing investors with the latest information becomes paramount. To this end, Percent provided its first update to investors on the COVID-19 situation on March 13, a week before the first state stay-at-home order in the United States was implemented in California. The update broke down some responses we received from originator partners to COVID-19 related questions we never thought we would have had to ask.

Since that update was published, we have continued to keep investors informed of conditions in private credit markets and our own note programs specifically. For example, Percent hosted its first Quarterly Investor Update in April in a webinar format that allowed investors to put questions to members of the management team at Percent. The team discussed Percent's originator onboarding and risk management practices and the Q&A focused mostly on the effects of COVID-19 on our originators and note programs. More on that below.

In case you missed it, you can watch a recording of the Investor Update. On top of this presentation, we have also provided new weekly Capital Markets Updates in an audio format to supplement our monthly written-form Capital Markets Updates. All these resources are available on the Insights section of our website.

Percent has also spent the past two months providing investors with more data and information on how the assets collateralizing their investments are performing. Just for the insights they provide about the economy, these resources are worth exploring. For one, Percent has rolled out Real Time Performance data for more note programs.

This feature, accessible from the deal pages for the notes in question, shows the state of an originator’s portfolio on a loan-by-loan basis. You can use this tool to get some quick statistics on the portfolio and see how individual assets are performing. Also, consider that because we have originators whose businesses serve both brick & mortar retail and e-commerce, and both these originators give us Real Time Performance data, investors are able to gauge how much stronger origination trends have been in the e-commerce sector versus brick & mortar retail.

Percent has also launched new Surveillance Reports that provide even more analysis of performance using the same data that feeds into the Real Time Performance data discussed earlier. Recall that we mentioned our view that the cross-sectional impact of this downturn would be truly unique. These Surveillance Reports reveal some of the disparate effects of the economic slump.

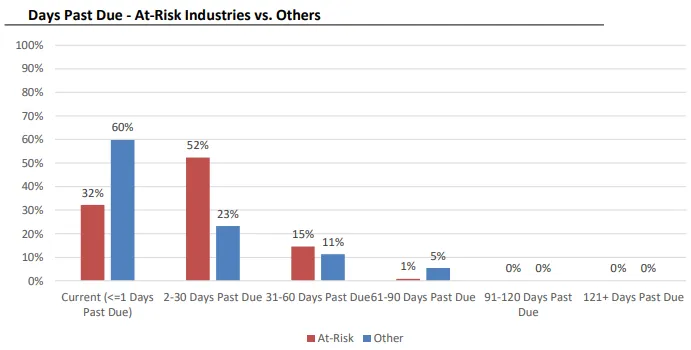

For example, the reports break down the effects of COVID-19 on the most at-risk US states and industries. As you can see on the chart from the May 11th report for one originator, at-risk industries (those believed to be most affected by COVID-19, like leisure and hospitality) were seeing worse performance compared to other industries. The exception is the “61-90 Days Past Due” bucket but this is likely due to pre-COVID issues considering that no stay-at-home orders were in place that long ago.

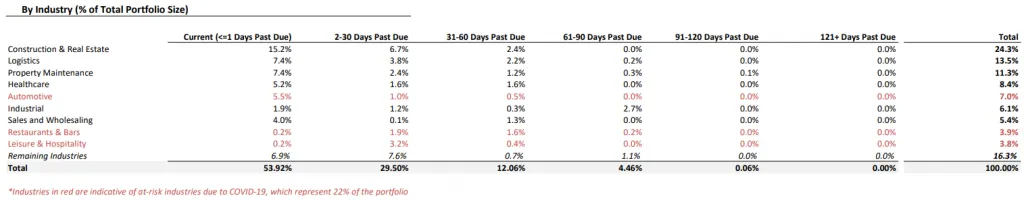

If we break down the industry performance further, even more valuable information is revealed. For example, the following table from the same report as the above chart shows that not all seemingly at-risk industries are equally affected. For example, borrowers in the automotive sector are proving more resilient despite consumers avoiding travel and road traffic volumes being lighter. Unsurprisingly, the picture is very different for borrowers in the leisure and hospitality sector. A far larger proportion of those borrowers are not current on their obligations.

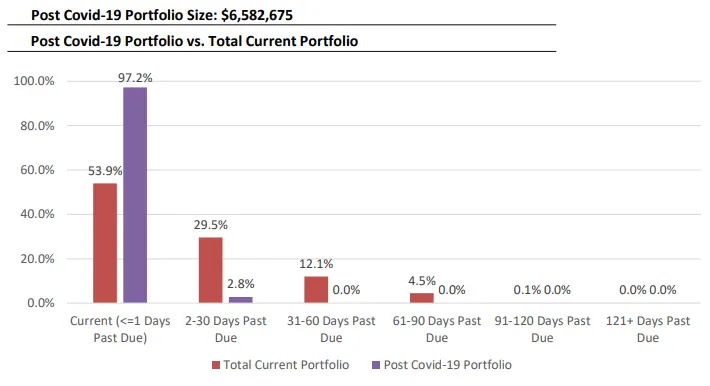

That said, many originators have changed their origination practices since the start of the most recent downturn. Where these changes are substantial, we report the differing performance of pre-COVID and post-COVID loan vintages, with the expectation that the later would perform better. The chart below from the same report referred to above reveals this sharp improvement in performance for one originator. These reports can be accessed on the originator pages viewable under the “Our Originators” section of our website. We currently have such reports available for four originator partners but continue to roll this out to more. Given the valuable and actionable information contained in these reports we invite you to create a Percent account to gain access.

Protecting Investors

There is more to be done than just informing investors when we are well positioned to take measures designed to reduce risk. This is an advantage of the short duration of Percent's note programs. Because notes are under a year in duration, programs can be altered to address risks to investors more frequently.

To this end, Percent has taken steps as varied as shortening note tenors, increasing first loss provisions, and introducing more notes with amortization periods to reduce risk. Regarding the latter, in cases where the nature of the originator’s portfolio allows, an amortizing note can reduce risk by returning capital to investors sooner than the maturity date. Where portfolio performance has deteriorated, first loss cushions have increased. For example, one originator’s 3-month note program has seen the first loss protection attached to their notes rise from 15% of the note amount to 25%.

Besides these measures, Percent has continued to track developments at originator partners and their industries to ensure non-credit risks are also addressed. These include liquidity risk, operational risk, and currency risk. Operational reviews of new originator partners increasingly focus on these risk factors as well as business continuity.

Lastly, Percent has given investors the chance to give their input on where note programs should be priced through a system of Dutch auctions. You can read more about this here but, in essence, Dutch auctions allow investors to indicate how much they would invest as various yield levels for any given note program. This has been a valuable feedback mechanism for Percent, giving us more confidence with respect to market-clearing levels for different note programs. It also gives our originators more comfort as to the security of their funding sources in such trying times. The Dutch auction mechanism has already altered the APYs on several note programs; investors are being heard. If you are signed up with Percent, you should be receiving emails about new Dutch auctions roughly weekly.

What this Means Going Forward

The economic trends set in place by COVID-19 are here to stay, at least for a little while longer. As a result, we continue to be extra-motivated to inform and protect investors. The Percent team will continue to roll out Real Time Performance data and Surveillance Reports for more originators and their note programs. Percent will also continue to provide frequent updates in multiple formats to investors on our platform. We hope investors continue to take comfort in these ongoing actions as Percent continues to grow, welcoming new investors and asset originators to its dynamic investment platform.