The State of Inflation: Origins, Obstacles, and Opportunities

Few subjects in finance at the moment are as relevant as inflation.

The U.S., like many developed global economies, finds itself mired in a period of high inflation that is eroding living standards and leading to imbalances in the global economy.

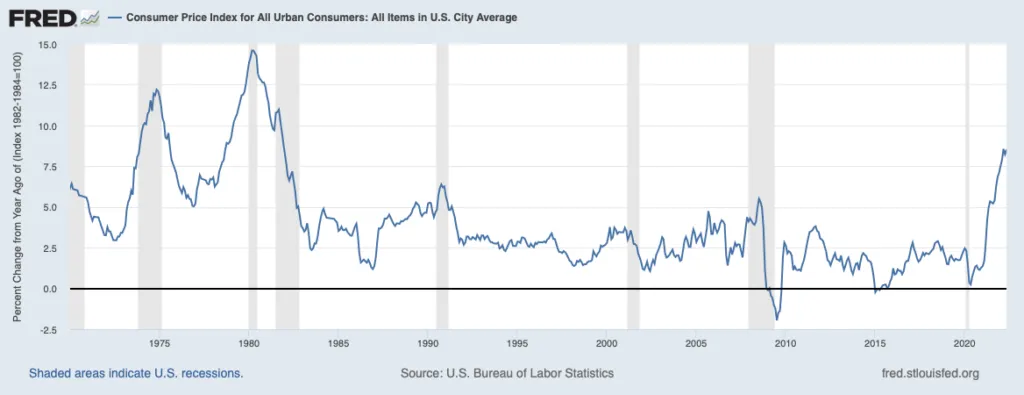

- In May of this year, the Consumer Price Index (“CPI,” encompassing all goods and services) increased to 8.6%/annum in the U.S., significantly above the targeted inflation rate of the Federal Reserve of 2%/annum.

- The May inflation print was the highest level for CPI since December 1981.

The steady increase in inflation occurred even as Fed Chairman Jerome Powell asserted confidently throughout 2021 that inflation would be transitory despite the fact that the U.S. economy, amongst many others, recently experienced unprecedented amounts of fiscal and monetary stimulus. The reality is that inflation has proven to be anything but transitory, as the CPI increased month after month following the onset of the pandemic.

- Though there was optimism that inflation was under control following a “down read” in CPI in April of 8.3%/annum (following 8.5%/annum for March), this proved to be short-lived. May’s CPI figure of 8.6%/annum rocked financial markets and greatly heightened concerns regarding the Federal Reserve’s ability to quickly tame inflation.

- Undoubtedly, inflation is proving to be stubbornly difficult to reign in. With food prices skyrocketing, supply chain disruptions leading to some products being in short supply or not available at all, and the price of gasoline surging to more than $5/gallon in some parts of the U.S., inflation is starting to bite many ordinary American households.

What Causes Inflation?

Inflation is usually caused by excess demand for goods and services, referred to in economic parlance as “demand-pull” inflation.

- This normally occurs when an economy is at full employment and is experiencing high capacity utilization, meaning the shortage of available labor and/or production facilities makes it difficult to produce sufficient goods or services to meet demand.

- The imbalance is addressed by increasing prices, which eventually restores the equilibrium between supply and demand. Demand-pull inflation is normally born out of excessive fiscal or monetary stimulus, which has come in droves since the onset of the pandemic.

- “Supply-push” inflation is inflation caused by higher input prices (e.g. oil or commodity prices), restrictions on the free movement of goods or services, or supply-chain disruptions. Controlling this type of inflation tends to be largely out of the purview of fiscal and monetary policy to influence.

- Addressing supply-push inflation is more nuanced and challenging for political leaders and central bankers since there are no remedies in the toolbox that can be readily used to address related factors.

What Caused Inflation to Rage During the Pandemic?

The global economy during the pandemic period experienced both demand-pull and supply-push inflationary factors.

- Aggressive monetary policy in the form of near-zero interest rates and aggressive purchases of bonds by the Federal Reserve kept interest rates artificially low in the U.S., spurring demand.

- Several rounds of fiscal stimulus under both the Trump and Biden administrations provided relief to Americans that were affected by the economic disruption of the pandemic. A good portion of this stimulus was funneled into consumption, firing up economic growth.

- Some of the excess liquidity also found its way into investments, driving some asset classes to speculative levels.

- Concurrently, the price of oil and other commodities are rapidly increasing, and supply-chain disruptions – many initially COVID-related and now also related to Ukraine-Russia conflict – led to bottlenecks that reduced supplies of goods and component parts. This increased the cost of component goods, which in turn drove up the prices of finished goods.

Why Is Inflation a Problem?

Higher Prices: Higher prices can become entrenched in the psyche of people, leading to a dangerous wage-price spiral in which consumers – forced to spend more of their income on higher-priced goods and services – demand wage increases to protect their standard of living.

- This spiral can be difficult to reverse once it becomes embedded in an economy and peoples’ way of thinking.

- Inflation affects lower income and middle-class people more severely than it affects more affluent people. The former tend to have a higher percentage of their income directed to everyday goods and services they need to maintain their standard of living, such as food, electricity, and the price of gasoline.

Price Bubbles: Inflation spurred by excess liquidity leads to asset price bubbles in select (and generally more speculative) financial asset classes like stocks and real estate, which again tend to be disproportionately held by the more affluent segment of the population.

- This exacerbates wealth redistribution, benefiting mostly affluent people with investments.

Inflation is notably a political liability for governments, especially the party in power. In the U.S., the Democrats are likely to suffer in the upcoming Congressional midterm elections as inflation becomes the key political talking point.

How Has the U.S. Experienced Inflation in the Past?

The U.S. experienced its last severe bout of inflation in the late 1970s to the early 1980s. Spikes in inflation were caused by excessive fiscal spending that began in the 1960s with the monetary policy-fueled funding of social programs and the Vietnam War. This ultimately led to Nixon ending the convertibility of U.S. dollars to gold in 1971.

- To address rising inflation, the Federal Reserve began to raise the key overnight bank borrowing rate (the Federal Funds rate) in early 1972. However, inflation continued to increase and was further exacerbated by the OPEC oil embargo that began in October 1973.

- This confluence of factors pushed inflation in the U.S. to 11% by early 1974 despite the Federal Reserve’s steady increase of interest rates. Inflation did not start to subside until the U.S. economy was deep in a recession that lasted from Q4 1973 to Q1 1975.

Though inflation declined following the recession, it only fell below 6%/annum for a short time. The Federal Reserve reduced the Federal Funds rate following the mid-1970s recession to stoke poor U.S. economic growth. This approach proved to be overly dovish as inflation started to steadily increase. Once again, the Federal Reserve was slow to respond with the vigor needed as far as tightening monetary policy.

- A further oil shock in 1979 caused by the Iranian Revolution worsened the outlook further as oil prices more than doubled between April 1979 and April 1980.

- Between March 1979 and October 1981, inflation remained mostly in double-digits, peaking at 14.6% in April 1980.

- A period of very tight monetary policy, where the Federal Funds rate peaked at 19.10% in June of 1981, led to a double-dip recession in the U.S. — one in 1980 and the second in 1981-1982. This period of time was known for economic “stagflation”, which is a period of simultaneous high inflation and poor economic growth.

Inflation fortunately remained largely subdued in the U.S. since the early 1980s. Even the aggressive fiscal and monetary stimulus unleashed during the Great Recession in 2007-2009 did not cause inflation to increase markedly because the recession was so deep.

Why Does the Federal Reserve Seem Unable to Control Inflation?

The circumstances of what was essentially a manufactured recession during the early stage of the pandemic and the policy responses by the government and Federal Reserve make the circumstances of the pandemic recession dramatically different than the Great Recession.

Moreover, the quantum of fiscal and monetary stimulus unleashed to restore the U.S. economy to growth following the initial pandemic shut-down was significantly greater than what was deployed during the Great Recession.

- Following the Great Recession, it took nearly 10 years for unemployment in the U.S. to return to pre-recession levels.

- After the initial pandemic recession, unemployment snapped back much more quickly, with U.S. employment now close to the pre-pandemic level (3.6% in May 2022 vs 3.5% in February 2020).

The graph below shows the time it took for unemployment to snap back following the Great Recession and the pandemic recession.

Excess liquidity from unprecedented amounts of pandemic stimulus found its way into increased consumption — first for goods and now for services. This has been the key catalyst for a robust economic recovery. Of course, some of this excess liquidity also found its way into speculative asset classes.

- What the Federal Reserve missed is their view, to which they adhered to much longer than was required, that inflation in the U.S. would be transient, meaning it would peak and then quickly return to the target level as the economy normalized.

- What was not sufficiently taken into consideration was that the Federal Reserve cannot control things like supply-chain disruptions resulting from COVID.

- Also, the invasion of Ukraine by Russia could not have been foreseen, and this has further exacerbated supply-chain disruptions. The most visible effect of the war has been on energy prices, as oil and gas prices have skyrocketed.

There was an abundance of stimulus deployed during the pandemic, which now creates the difficult task of reducing inflation without causing severe economic pain.

- The Federal Reserve acknowledged its mistakes and has turned decisively hawkish, embarking on a series of increases in the Fed Funds rates and – as of June 1 – has started to reduce its balance sheet (i.e. “quantitative tightening”).

- There will inevitably be economic consequences to these policy steps, which will slow the U.S. economy and increase unemployment.

The question is just how much pain will be required to rein in inflation. Slower growth is one thing, but a shrinking economy is another. Should the economy dip into a recession, the repercussions on Americans would be even more severe as the economy could very well be in for another period of stagflation.

How Could Inflation Shape My Investment Strategy?

The initial months following the onset of the pandemic were a period when most assets appreciated – including traditional asset classes like stocks and bonds. The enthusiasm in what appeared to be a one-directional market encouraged investors to take on more and more risk, as the outlook was bright, and inflation was not thought to be a significant threat.

However, as inflation became an increasingly relevant talking point in the first half of 2021, interest-rate sensitive asset classes started to take a beating.

- Naturally, this included nearly all types of fixed income securities, but also higher beta stocks, especially so-called “tech high flyers” that were cash flow negative in many cases.

- Blue chip equities remained reasonably firm, as did some segments of the fixed-income market – like high yield – that had sufficient spread cushion to shield against slowly rising U.S. Treasury yields.

- The beginning of 2022 brought on growing concerns about inflation as risk appetite began to wane further, with nearly all asset classes losing ground (some rather substantially).

An inflationary environment introduces all sorts of risks for investors, including higher yields in traditional bond markets that are particularly harmful even for what might appear to be the safest of investments (like U.S. Treasuries).

- Higher yields in bonds are particularly painful for investors that own long-duration assets, like intermediate and long-term fixed-income securities. With the 10-year U.S. Treasury yield at 3.15% (June 10th, 2022) and inflation now running at 8.6%/annum, investors are experiencing negative real returns since inflation is more than the nominal yield on the 10-year bond.

- Risk premia in the market are rising, pushing the prices of higher risk, longer-duration assets lower across the board.

- As inflation remains persistently high and the Federal Reserve has turned restrictive to address inflation, risks remain elevated for traditional asset classes like stocks and bonds.

This persistently-high inflationary environment and the ongoing hawkish approach by the Federal Reserve opens the door wider for alternative assets, including yield-accruing assets (like private credit) and collectibles (wine, vintage cards, art, etc) that might benefit from inflation.

Investors with the risk appetite could consider shorter-dated higher-yielding assets like private credit, which can provide investors with positive pick-ups over inflation (meaning positive real yields) in shorter-duration assets that are less rate sensitive.

How Can Percent Help Manage Against Inflation?

Private credit is an asset class of privately negotiated loans and debt financing from non-bank lenders. Percent helps investors access these high-yield, short-term private credit investments that run largely uncorrelated from public markets.

Though the private credit world has existed for decades, individual access to these investments is only a recent development. As a platform powering all sides of private credit transactions, Percent has helped investors access over $600 million in offerings across asset classes like litigation financing, corporate debt, and small/medium business financing.

With opportunities that can generate up to 18% APY and durations as short as one month in the event of a transaction refinancing, Percent is giving market-wary investors opportunities to manage inflation and volatility with private credit.