Percent Market Insights: May 3, 2022

This is the second edition of Percent Market Insights, a new newsletter from Percent featuring commentary from market veteran Tim Hall of E-Morning Coffee.

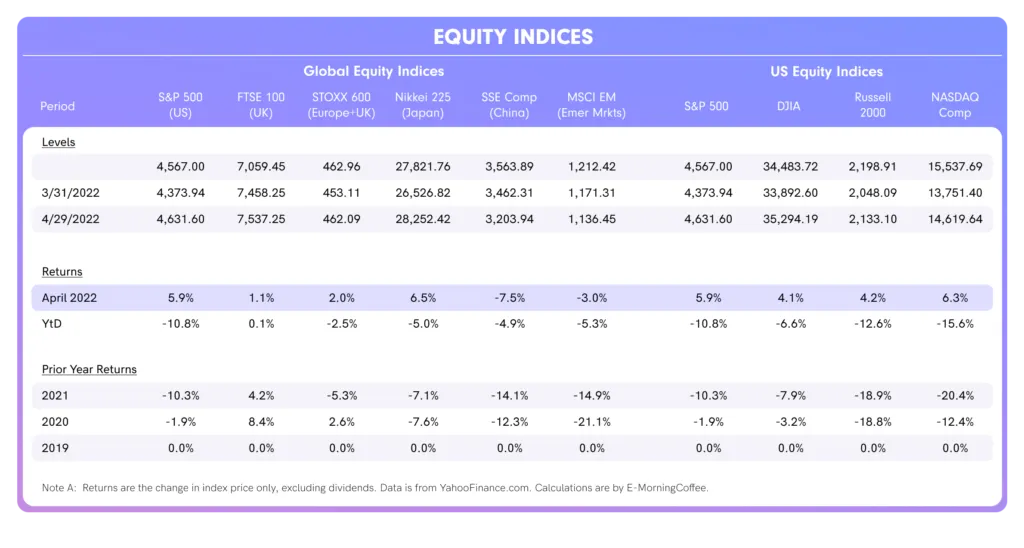

April was a hard month for bond and stock investors, with a confluence of factors weighing heavily on market sentiment. U.S. equity markets took the brunt of the global equity pain, with the tech-heavy NASDAQ index taking the worst beating.

As the month ended, volatility in both the equity and bond markets was severely elevated—not a positive sign for markets as the Federal Open Market Committee (“FOMC”) begins its two-day session today with a 50bps increase in the Federal Funds rate likely.

Geopolitical and Macroeconomic Risks Dominate

April was a month of two distinct halves, although unlike March, both halves were poor. For the first half of the month, investors focused mainly on geopolitical and macroeconomic risks, including:

- The ongoing Ukraine-Russia war;

- The Chinese economy — the world’s second largest — which was adversely affected by COVID-related shutdowns of selective (large) cities, including Shanghai and Beijing; and

- Inflation and related concerns about the appropriate monetary response of the Federal Reserve to tame inflation without tipping the economy into recession.

These concerns fueled an ongoing risk-off attitude and a flight out of bonds during the first two weeks of April. The S&P 500 declined 3%, and the yield on the 10-year U.S. Treasury increased sharply—from 2.32% at the end of March to 2.92% by April 14 (+51bps).

First Quarter Results Dominate

Investors turned their attention to first quarter earnings releases of the S&P 500 companies just before Easter. Though 275 companies have now reported their January-March results, investors were most focused on the results of and outlook for banks and technology companies.

- The view, which proved to be correct, was that first quarter results vis-à-vis expectations would either serve as a stabilizing influence, or, after a challenging start to the month, would lead to another leg down.

- Six of the largest U.S. banks reported decent earnings, very much in line with or slightly beating expectations. JP Morgan gave some investors pause when Chairman and CEO Jamie Dimon provided cautious guidance for the coming quarters.

- FAMAG stocks — Facebook (now Meta Platforms), Apple, Microsoft, Amazon, and Google (Alphabet) — delivered mixed results. Meta Platforms beat consensus expectations, and the stock rallied off of a low base. Apple and Microsoft also beat consensus expectations, while Alphabet (Google) slightly disappointed.

- The real surprise was Amazon, which reported its Q1 2022 results after the close on Thursday (April 27). Not only did the company miss analysts’ consensus figures, but it also served up a bottom line loss which was not well received by investors, along with disappointing guidance for the coming quarter.

Beyond FAMAG: Beyond the mega—cap tech giants, earnings season for the market as a whole was predominantly good.

- Refinitiv highlighted in their recent weekly summary that 80.4% of companies reporting first quarter results beat analysts’ consensus bottom-line expected earnings (versus a long-term average of 66%), and 72.7% have beat analysts’ consensus expected revenues (versus a long-term average of 61.6%).

- In a market that increasingly feels heavy (per investor and analyst sentiment) and faces a variety of concerns, the combination of mixed results and cautious full-year guidance – particularly from Amazon – pushed investors over the edge on the final trading day of the month.

- The NASDAQ plummeted 4.2% on Friday (April 29), capping a loss of 13.3% in April alone.

Troubles Ahead: Investors are focusing not only on the most recent quarterly results, but also what may lay ahead.

- Though earnings have been good in the aggregate, management has provided cautious guidance primarily due to ongoing supply chain issues exacerbated by COVID outbreaks in China and the war in Ukraine.

- As witnessed with Amazon, inflationary wage pressures are also causing problems for businesses.

Macroeconomic Events

April’s macroeconomic themes remain similar to those experienced in March, as inflation raced even higher in the U.S, the U.K., and the Eurozone.

- CPI in March (released mid-April) for the U.S.was 8.5% YoY, the highest since 1981.

- Inflation in the U.K. was 7.0% for March and 7.4% in the Eurozone (7.8% in the EU). All of these hot inflation reads are forcing the Federal Reserve, the Bank of England and the European Central Bank (“ECB”) to navigate the fine line between tightening monetary policy to curtail rising inflation without slowing economic growth too aggressively.

- Both the Bank of England and the Federal Reserve release policy statements the first week of May, with both expected to raise the overnight bank borrowing rate.

- Longer term, investors in the U.S. seem to be bracing for a potential overshoot by the Federal Reserve, with growing concerns over a potential recession.

- The release of Q1 2022 GDP for the U.S. did the market no favors, though the figure was deceiving. The headline figure showed that the U.S. economy contracted 1.4% in Q1 2022, while economists and investors were expecting growth. The culprit was a decrease in net exports, caused by a sharp increase in the purchase of imports.

- Personal consumption expenditures – an important component of GDP – also remain solid, as the U.S. economy continues to grow impressively. Insured unemployment fell to 1,408,000 for the week ending on April 16, 2022, the lowest level in over 50 years).

In summary, data suggests that inflationary pressures remain acute in the U.S.

Equities Performance

Out of the indexes we track at Percent, only the FTSE 100 (U.K.) ended positive in April and for the year. Other global indices had negative returns in April, none worse than the S&P 500.

- The weakness has been broad-based although technology shares have been a very material contributor to the decline because the mega-cap technology stocks (FAMAGs) account for a significant percentage (~25%) of the S&P 500.

- Technology stocks, especially many of the high flyers, have been particularly vulnerable because they rose to such unsustainable valuations during the pandemic.

Volatility: Volatility has also increased since early April. The volatility index (VIX), which traded either side of 20 for most of the past year, closed Friday at 33.4, a level not seen since early March following the start of Russia’s invasion of Ukraine.

Bond Performance

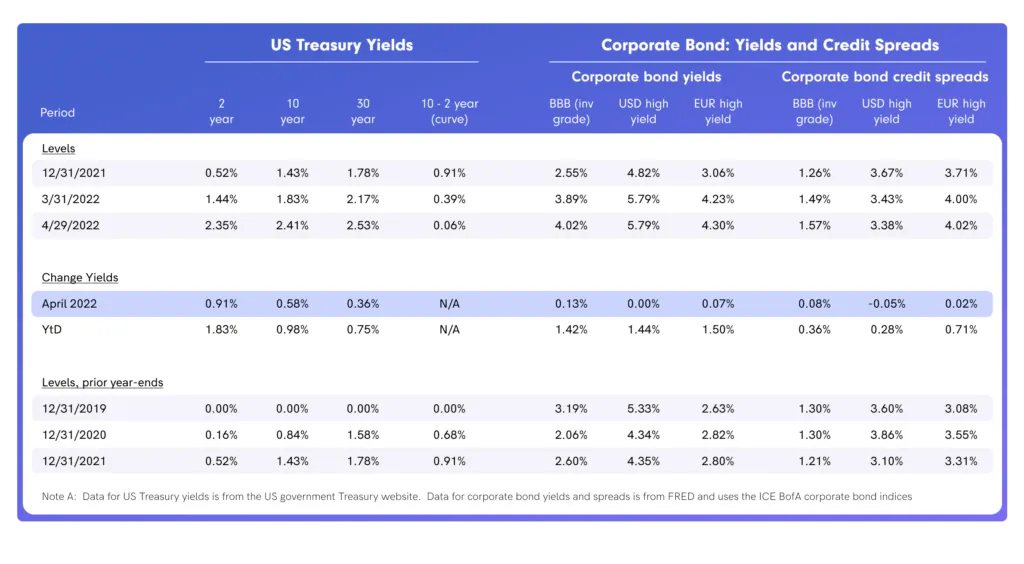

Yields

U.S. Treasury yields rose sharply during April across the curve, with the benchmark 10-year UST yielding 2.89% (+57bps) at the end of April. For months, the yield on the 2-year UST – which increased to 2.70% at the end of April – signaled to the Federal Reserve that it needs to tighten monetary policy to address inflationary pressures.

- Yields in the corporate bond market, both investment—and non—investment grade (i.e. high yield), increased as might be expected given the significant increase in underlying yields on U.S. Treasuries.

- Credit spreads also widened, more severely in high yield than investment grade.

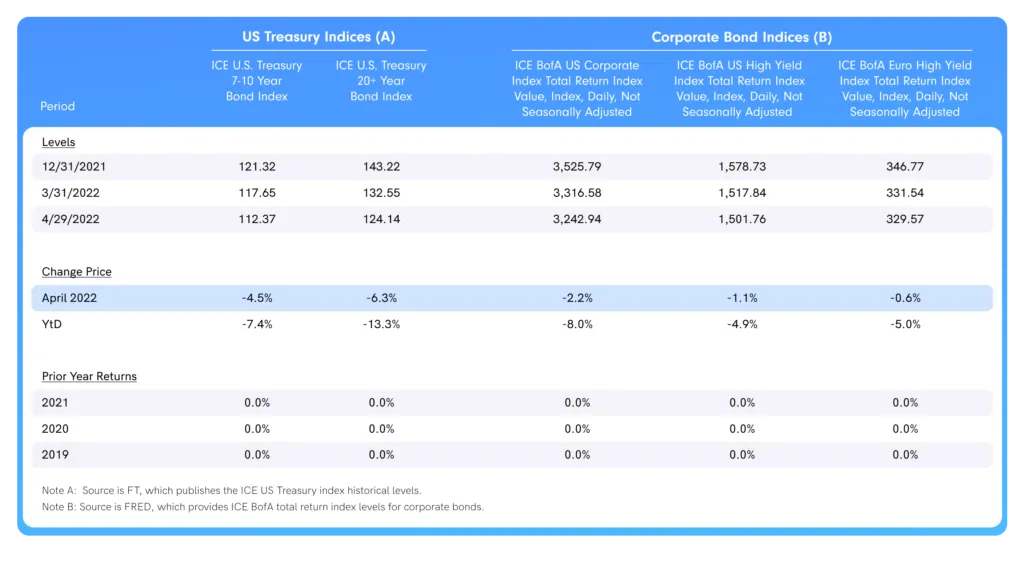

Returns: Given that yields are under pressure, returns in U.S. Treasuries and corporate bonds were poor in April, continuing the trend since the start of the year. As seen in the table below, longer duration bonds (like the U.S. Treasury Bond 20+ Year Index) suffered the most as yields rose.

Corporate bonds provided a better relative return to investors, albeit still negative, with high yield bonds performing the best.

- Higher UST yields hurt high-yield bonds, too, but less because the larger credit spread provides more protection against rising rates.

- There is no visible sign of stress in the credit markets at the moment, though if investors start to fear a recession, corporate bonds – especially high-yield bonds – could sell off.

Currencies

The U.S. Dollar continued to strengthen week after week (against a basket of currencies), while the Japanese Yen continued to decrease. Foreign exchange is always a matter of the currencies being compared and the underlying economic dynamics of each economy.

- The U.S. Dollar continued to strengthen due to the relative strength of the U.S. economy (vs. other economies), as well as the vocal rhetoric and hawkish shift by the Federal Reserve to raise interest rates in the US.

- The U.S. Dollar is now at its strongest point vis-à-vis the U.K. Pound since the beginning of the pandemic, and against the Euro since the end of 2016.

- The U.S. Dollar has increased 7.9% year-to-date, and 4.9% in April.

The Yen has weakened considerably and consistently against the U.S. Dollar and most other G7 currencies because the Bank of Japan remains extremely dovish, actively and aggressively purchasing Japanese government bonds in the open market to keep long-term yields low in Japan.

- As the dovish policies of the Bank of Japan diverge increasingly from the more hawkish view of the Federal Reserve and most other central banks, you can expect the Yen to continue to weaken.

- The Yen is down 11.4% against the U.S.Dollar YTD, and fell 4.8% in April.

Alternative Assets and Oil

The most watched asset outside of equities and bonds has been oil, mainly because it is at the center of the sanctions against Russia.

- The price of West Texas Intermediate (WTI) crude has stabilized in the $95-$105 area, fluctuating less severely recently.

- In April, the price of WTI crude ended the month about where it started.

- Global oil seems to be more stable for the moment, and the Biden Administration helped by announcing that it would release oil daily from the country’s Strategic Petroleum Reserves over a six-month period.

Crypto: Bitcoin did well to hold its own even as equity and bond markets became more unsettled and volatile during the first quarter.

- However, in April the price of Bitcoin started to weaken along with other risk assets, closing last week at $38,610, which is a decline of 18.7% for April (using April 29 end of day price).